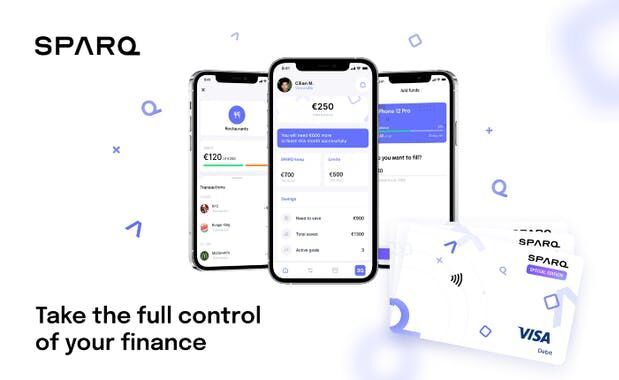

SPARQ is a Personal Finance Platform for Millennials and Gen Z

Laura McQuarrie — July 28, 2021 — Tech

References: sparq.eu & producthunt

SPARQ, a personal finance platform geared towards Millennials and Gen Z, aims to provide payment solutions, all-in-one money management resources and an engaging gamified experience for its target demographic. The platform promises to be a handy place for keeping tabs on everything from income and expenses to savings, and the in-app personal assistant SPARQAN provides feedback along the way. The gamified app is devoted to telling the story of a financial hero and users get to collect "qpoints," complete challenges and more.

Already, SPARQ has developed its payment solution and it is on a mission to close its seed round to develop the other parts of the personal finance platform so that it can be experienced to the fullest.

Already, SPARQ has developed its payment solution and it is on a mission to close its seed round to develop the other parts of the personal finance platform so that it can be experienced to the fullest.

Trend Themes

1. Gamified Personal Finance - There is an opportunity for startups to create gamified personal finance platforms that offer incentives and feedback for Millennials and Gen Z users.

2. All-in-one Money Management - There is an opportunity for companies to develop all-in-one money management resources that offer Millennials and Gen Z users a comprehensive solution for their finance needs.

3. Personalized Financial Guidance - There is an opportunity for businesses to create personal finance platforms that provide Millennials and Gen Z users with personalized feedback and guidance on their financial habits and decisions.

Industry Implications

1. Fintech - Fintech companies have the opportunity to develop personal finance platforms with game-like features and personalized guidance for Millennials and Gen Z users.

2. Banking - Banks can innovate by creating all-in-one money management solutions that cater to Millennials and Gen Z users.

3. Education - Educational institutions can develop personal finance courses and gamified apps for Millennials and Gen Z users, offering a new way to learn about financial literacy.

4.3

Score

Popularity

Activity

Freshness