Rhino Announced a New Product Designed to Help Small-Sized Landlords

Francesca Mercurio — August 20, 2021 — Business

References: coverager

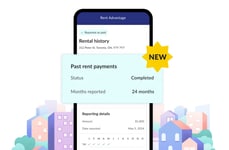

New York-based insurtech company Rhino, announced the launch of its new program that is designed to help small- and medium-sized landlords.

The program will offer landlords a platform where renters can pay their security deposit insurance efficiently and safely. The COVID-19 pandemic drastically affected small landlords, many of which were forced out of business. The service works by paying Rhino a monthly fee (which can be as little as USD $4); and in return, Rhino covers the cost of the renter's upfront security deposit among other fees.

Rhino's new platform helps both landlords and renters as it offers an affordable solution to upfront security deposits that renters often cannot afford. By offering such a service, it opens up the pool of potential renters for landlords to pick from.

The program will offer landlords a platform where renters can pay their security deposit insurance efficiently and safely. The COVID-19 pandemic drastically affected small landlords, many of which were forced out of business. The service works by paying Rhino a monthly fee (which can be as little as USD $4); and in return, Rhino covers the cost of the renter's upfront security deposit among other fees.

Rhino's new platform helps both landlords and renters as it offers an affordable solution to upfront security deposits that renters often cannot afford. By offering such a service, it opens up the pool of potential renters for landlords to pick from.

Trend Themes

1. Security-deposit Insurance Programs - Insurtech companies can disrupt the real estate industry by providing affordable security deposit insurance programs to renters, which can help small landlords attract more renters.

2. Rent Payment Platforms - Fintech companies can disrupt the real estate industry by offering secure and efficient rent payment platforms that can benefit both landlords and renters.

3. Small Landlord Support - Companies offering programs that support small landlords and address their pain points can potentially disrupt the real estate industry by catering to an underserved market segment.

Industry Implications

1. Insurtech - Insurtech companies can capitalize on the opportunity to disrupt the real estate industry by offering cost-effective and efficient security deposit insurance programs to renters.

2. Fintech - Fintech companies can disrupt the real estate industry by offering secure, flexible, and convenient rent payment platforms that benefit both landlords and renters.

3. Real Estate - Companies that offer targeted programs to support small landlords and address their specific pain points can potentially disrupt the real estate industry by tapping into an underserved market segment.

1.2

Score

Popularity

Activity

Freshness