Top Five Solutions to Keep Your Finances In Check

Trend Hunter — May 21, 2014 — Lifestyle

References: TotallyMoney & moneyadviceservice.org.uk

We all know keeping a handle on your money is no easy task. Fortunately, technology can make things that little bit easier. Below is a list of tools and websites which can help you.

Budget Tool by MAS

The Money Advice Service’s free budget tool is a must have. In less than five minutes you can know much you have to spend each month after your major bills have been paid. The more detailed version takes 20 minutes and will help you understand exactly where your money is going.

Credit Checker by TotallyMoney.com

To really take control of your finances, you need to know where you stand. This free toolfrom TotallyMoney.com allows you to check your credit score. It’s a great tool with further tips on how to improve your score. If you have a “bad” score and need finance, there’s no need to worry. The tool can also help you find what credit options are best suited to your situation.

Pension Calculator by CNN

To truly be in control of your finances, it is a good idea to start looking at a pension. To get some idea of what you need to save, use CNN’s free tool to calculate how much you need to save. There are better, more in-depth tools, but this one gives you a quick idea of whether you’re saving enough.

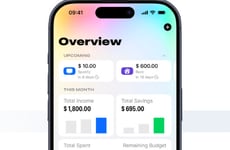

Spending App on iTunes

No tech list would be complete without a trusty app. Try the Spending app on iTunes. It lets you input your weekly/monthly budget, and easily allows you to record each transaction. There’s no easier way to keep track of expenses.

Savings Calculator by MAS

Another great tool by MAS which helps you calculate how long you’ll need to save for or how much you’ll need to save by a certain date. Use the free tool to see what you need to save. For example, it would take 14 years and five months to save £25,000 at £100 per month (with 5% interest). According to the tool, you could reach the target almost four years sooner by saving an extra £47 per month.

Budget Tool by MAS

The Money Advice Service’s free budget tool is a must have. In less than five minutes you can know much you have to spend each month after your major bills have been paid. The more detailed version takes 20 minutes and will help you understand exactly where your money is going.

Credit Checker by TotallyMoney.com

To really take control of your finances, you need to know where you stand. This free toolfrom TotallyMoney.com allows you to check your credit score. It’s a great tool with further tips on how to improve your score. If you have a “bad” score and need finance, there’s no need to worry. The tool can also help you find what credit options are best suited to your situation.

Pension Calculator by CNN

To truly be in control of your finances, it is a good idea to start looking at a pension. To get some idea of what you need to save, use CNN’s free tool to calculate how much you need to save. There are better, more in-depth tools, but this one gives you a quick idea of whether you’re saving enough.

Spending App on iTunes

No tech list would be complete without a trusty app. Try the Spending app on iTunes. It lets you input your weekly/monthly budget, and easily allows you to record each transaction. There’s no easier way to keep track of expenses.

Savings Calculator by MAS

Another great tool by MAS which helps you calculate how long you’ll need to save for or how much you’ll need to save by a certain date. Use the free tool to see what you need to save. For example, it would take 14 years and five months to save £25,000 at £100 per month (with 5% interest). According to the tool, you could reach the target almost four years sooner by saving an extra £47 per month.

Trend Themes

1. Personal Financial Tracking - Implementing innovative personal financial tracking tools can revolutionize how individuals manage their money and make informed financial decisions.

2. Credit Score Checker - Developing advanced credit score checker tools can empower individuals to understand and improve their credit scores, opening up more financial opportunities for them.

3. Pension Planning - Creating user-friendly pension planning tools can encourage individuals to be more proactive in understanding and saving for their retirement, ensuring financial stability in their later years.

Industry Implications

1. Fintech - The fintech industry can leverage personal financial tracking tools to provide innovative solutions for budgeting, credit score monitoring, and pension planning, enhancing the overall financial well-being of individuals.

2. Mobile App Development - The mobile app development industry can capitalize on the growing demand for user-friendly spending apps that efficiently track expenses and help individuals stay within their budgets.

3. Financial Education - The financial education industry can incorporate personal financial tracking tools into their curriculum to empower individuals with the necessary knowledge and skills to manage their finances effectively.

6.9

Score

Popularity

Activity

Freshness