Orlando Credit Union Has Introduced a New Digital Branch

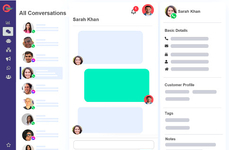

Orlando Credit Union's new Digital Branch will allow members to access banking services online anytime and from anywhere. This platform enhances the existing online services by consolidating various banking functions into a single interface and making it easier for users to manage their accounts. The move responds to member feedback that emphasizes g a desire for more sophisticated digital banking solutions that go beyond traditional brick-and-mortar services.

Orlando Credit Union's new Digital Branch offers several advantages for consumers. The convenience of 24/7 access enables users to perform banking transactions at their own pace. Enhanced features provide exclusive tools for managing accounts, while improved security measures ensure safer online transactions. Additionally, self-service options give members greater control over their financial activities, a move that aligns with modern banking trends that favor digital solutions.

Image Credit: Orlando Credit Union

Orlando Credit Union's new Digital Branch offers several advantages for consumers. The convenience of 24/7 access enables users to perform banking transactions at their own pace. Enhanced features provide exclusive tools for managing accounts, while improved security measures ensure safer online transactions. Additionally, self-service options give members greater control over their financial activities, a move that aligns with modern banking trends that favor digital solutions.

Image Credit: Orlando Credit Union

Trend Themes

1. Enhanced Digital Banking Platforms - Innovative digital banking platforms that consolidate various services into a single interface cater to user demand for streamlined and comprehensive online financial management.

2. 24/7 Self-service Banking - Consumers are increasingly gravitating towards financial services that offer round-the-clock access and self-management capabilities, allowing them greater flexibility and control over their banking needs.

3. Heightened Online Security Measures - New digital banking solutions are prioritizing enhanced security features to protect user data and transactions, meeting the critical need for safer digital financial environments.

Industry Implications

1. Fintech - The FinTech industry continues to evolve with the integration of sophisticated digital banking solutions that improve user experience and operational efficiency.

2. Cybersecurity - Heightened demand for enhanced online security in digital banking platforms is driving growth and innovation in the cybersecurity sector.

3. Digital Service Providers - Companies specializing in digital service solutions are at the forefront of transforming traditional banking experiences into seamless, interactive online platforms.

2.8

Score

Popularity

Activity

Freshness