VoguePay is a User-Centric & Expanding Nigeria-Based Service

Kalin Ned — March 5, 2019 — Social Good

References: voguepay & cryptobriefing

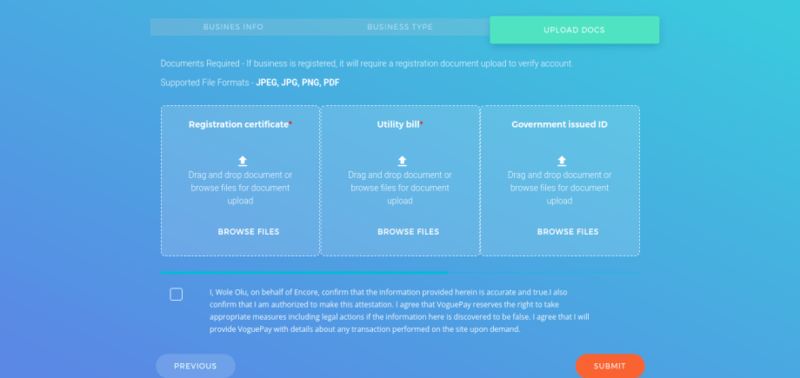

A Nigerian online payment processor is steadily growing in popularity in Africa as it offers a secure, efficient and cost-effective way to transfer money between individuals and across businesses. In its first year, the start-up secured 17,000 users and that has quickly grown to a portfolio with 100,000 small and medium-sized enterprises. Aside from its easy-to-use interface and its affordability, a major selling point of VoguePay is that it offers free integration for merchants.

The online payment processor ventures outside of the immediate financial sphere as well, teaming up with the International Criminal Police Organization to "developed a blockchain-based action and information portal for crime control." Other projects for VoguePay include the initiation of a digital banking platform and "a blockchain-based financial history and credit rating system."

The online payment processor ventures outside of the immediate financial sphere as well, teaming up with the International Criminal Police Organization to "developed a blockchain-based action and information portal for crime control." Other projects for VoguePay include the initiation of a digital banking platform and "a blockchain-based financial history and credit rating system."

Trend Themes

1. Growing Popularity of Online Payment Processors in Africa - The increasing adoption of online payment processors in Africa presents an opportunity for businesses to expand their customer base and streamline financial transactions.

2. Integration of Blockchain Technology in Payment Processors - The integration of blockchain technology in payment processors opens up new possibilities for efficient and secure financial transactions, potentially disrupting traditional banking systems.

3. Expansion of Digital Banking Platforms - The expansion of digital banking platforms allows for convenient and accessible financial services, creating opportunities for businesses to reach unbanked populations.

Industry Implications

1. Online Payment Services - The online payment services industry is expected to experience significant growth in Africa as more individuals and businesses adopt digital financial solutions.

2. Blockchain Technology - The blockchain technology industry has the potential to disrupt traditional financial systems by providing secure and transparent transactions.

3. Digital Banking - The digital banking industry is poised for growth as more consumers seek convenient and accessible financial services through online platforms.

2.9

Score

Popularity

Activity

Freshness