'Club Walrus' Lets Users Maintain More Independence

Michael Hemsworth — March 14, 2020 — Lifestyle

References: clubwalrus & betalist

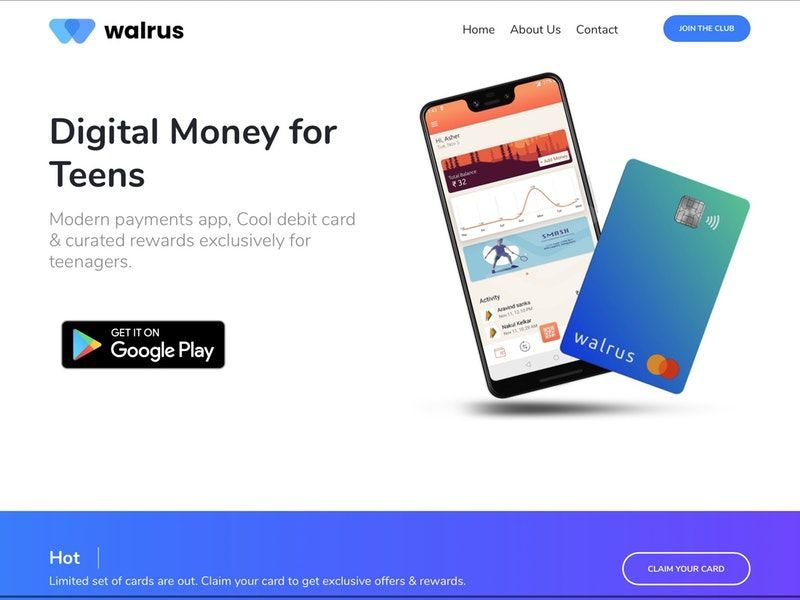

'Club Walrus' is a new neobank (digital-only banking solution) for teenagers in India that will provide them with a way to enhance their financial independence and help them to take more responsibility for their money.

The banking service is created specifically with teens in mind with hip debit cards for them to carry with them as well as an interactive app that features easy-to-understand graphs as well as an array of other data. The service will also provide users with curated rewards that they will actually strive for to make it as targeted towards young consumers as possible.

The 'Club Walrus' banking service will teach young consumers how to make the most of their money, while also encouraging them to save as much as possible.

The banking service is created specifically with teens in mind with hip debit cards for them to carry with them as well as an interactive app that features easy-to-understand graphs as well as an array of other data. The service will also provide users with curated rewards that they will actually strive for to make it as targeted towards young consumers as possible.

The 'Club Walrus' banking service will teach young consumers how to make the most of their money, while also encouraging them to save as much as possible.

Trend Themes

1. Teen-targeted Neobanks - The rise of digital-only banks specifically designed for teenage users presents opportunities for disruptive innovation in financial education and the youth market.

2. Interactive Financial Apps - The development of interactive apps with easy-to-understand graphs and curated rewards offers opportunities for disruptive innovation in digital banking experiences for young consumers.

3. Youth Financial Independence - The focus on enhancing financial independence and responsibility among teenagers through dedicated neobanks opens up opportunities for disruptive innovation in financial literacy and personal finance tools.

Industry Implications

1. Neobanking - The emergence of teen-targeted neobanks creates disruptive innovation opportunities in the banking industry to cater to a younger demographic and their unique financial needs.

2. Fintech - The development of interactive financial apps for teenagers presents disruptive innovation opportunities in the fintech industry to deliver engaging and educational digital banking experiences.

3. Education - The focus on youth financial independence and financial education provided by teen neobanks presents disruptive innovation opportunities in the education industry to integrate personal finance knowledge into school curricula and online learning platforms.

5.7

Score

Popularity

Activity

Freshness