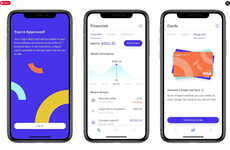

Be Money is a Welcoming Alternative to Traditional Banking Services

Be Money is still in its pre-customer phase but when it launches, the start-up will help diversify the finance space, making banking more inclusive and less intimidating.

The digital banking solution is poised to address a gap in the industry—the underserved LGBT+ community which constitutes "$1 trillion in spending power in the U.S." Be Money is scheduled to launch in November 2020 with a closed beta group. The focus will be exclusively on the LGBT+ people, with a commitment to "fulfill all their hopes and dreams." From accessible investment management with LGBT+ stock advice and financial advice from LGBT+ peers or experts to a spending card with automatic transfers and savings and investment options with competitive interest rates, Be Money is sure to welcomed addition to the industry.

Image Credit: Be Money

The digital banking solution is poised to address a gap in the industry—the underserved LGBT+ community which constitutes "$1 trillion in spending power in the U.S." Be Money is scheduled to launch in November 2020 with a closed beta group. The focus will be exclusively on the LGBT+ people, with a commitment to "fulfill all their hopes and dreams." From accessible investment management with LGBT+ stock advice and financial advice from LGBT+ peers or experts to a spending card with automatic transfers and savings and investment options with competitive interest rates, Be Money is sure to welcomed addition to the industry.

Image Credit: Be Money

Trend Themes

1. Inclusive Banking - Be Money is disrupting the banking industry by catering specifically to the underserved LGBT+ community, providing inclusive banking services and addressing their unique needs.

2. Digital Financial Services - Be Money is leveraging digital technology to offer innovative financial services, such as accessible investment management and automatic transfers, providing a convenient and efficient banking experience.

3. Empowering LGBT+ Community - Be Money is empowering the LGBT+ community by providing them with financial resources, advice, and support to help fulfill their hopes and dreams, fostering their financial success and well-being.

Industry Implications

1. Banking - Be Money is disrupting the traditional banking industry by offering innovative and inclusive financial services tailored to the needs of the LGBT+ community.

2. Fintech - Be Money is a prime example of how fintech companies can tap into underserved markets, such as the LGBT+ community, and provide them with specialized financial solutions.

3. Digital Investments - Be Money's inclusive investment management services that offer LGBT+ stock advice and peer/expert support, opens up opportunities for growth and disruption in the digital investment industry.

4

Score

Popularity

Activity

Freshness