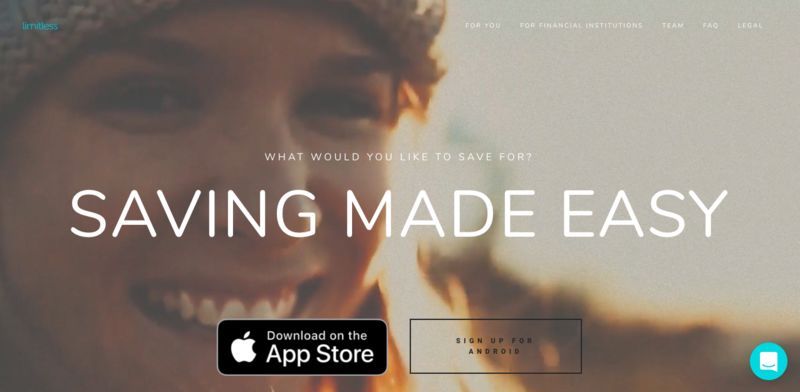

The Limitless App Helps People to Save Money Without Sacrifices

References: limitlessapp.io & producthunt

Saving money is difficult, but with the Limitless app, the process can be automated. The app uses goal-oriented plans to help people save, and it automatically pulls predetermined amounts of money from users' accounts to squirrel that money away and achieve those goals.

Everyone knows that changing habits is a direct way to save money, but that's a lot easier said than done. Sure, ordering food less often is a great way to save in the long run, but it's a Herculean feat to break the habit when it's so much easier than cooking meals at home. The Limitless app recognizes that changing one's behavior might not be realistic, so it automatically sends a predetermined percentage of every expense (from as little as two percent to as much as 20) to a dedicated savings account.

Everyone knows that changing habits is a direct way to save money, but that's a lot easier said than done. Sure, ordering food less often is a great way to save in the long run, but it's a Herculean feat to break the habit when it's so much easier than cooking meals at home. The Limitless app recognizes that changing one's behavior might not be realistic, so it automatically sends a predetermined percentage of every expense (from as little as two percent to as much as 20) to a dedicated savings account.

Trend Themes

1. Automated Saving - Disruptive innovation opportunity: Develop a more sophisticated micro-saving app that uses advanced algorithms to analyze spending patterns and automatically save money.

2. Goal-oriented Saving - Disruptive innovation opportunity: Create a micro-saving app that allows users to set specific financial goals and provides personalized plans and insights to help them achieve those goals.

3. Behavioral Finance - Disruptive innovation opportunity: Combine behavioral science principles with micro-saving apps to create interventions that effectively change spending habits and promote healthier financial behaviors.

Industry Implications

1. Fintech - Disruptive innovation opportunity: Develop innovative micro-saving solutions that integrate with existing financial technology platforms to provide seamless user experiences and maximized savings potential.

2. Personal Finance - Disruptive innovation opportunity: Create comprehensive personal finance platforms that incorporate micro-saving features, budgeting tools, and financial education to empower individuals to take control of their financial future.

3. Data Analytics - Disruptive innovation opportunity: Utilize advanced data analytics techniques to extract valuable insights from user spending patterns and behavior, enabling the development of smarter and more personalized micro-saving strategies.

2.9

Score

Popularity

Activity

Freshness