WhatsApp Launched In-App Payments Initially Available in Brazil

Daniel Johnson — June 16, 2020 — Tech

References: blog.whatsapp & techcrunch

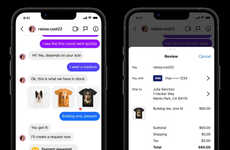

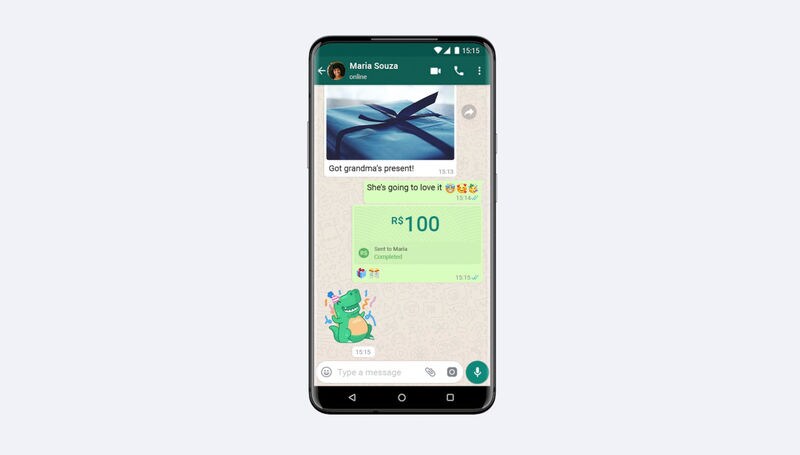

WhatsApp recently launched in-payments capabilities, which will be initially released in Brazil. The feature was in development for several months, and the company indicated that in-app payments are ready for widespread use.

The company released a statement about the launch, “The over 10 million small and micro businesses are the heartbeat of Brazil’s communities. It’s become second nature to send a zap to a business to get questions answered. Now in addition to viewing a store’s catalog, customers will be able to send payments for products as well.”

Users can access the feature by liking their WhatsApp with a credit or debit account, made possible through partnerships between WhatsApp and Brazilian financial institutions including Banco do Brasil, Nubank, as well as Sicredi.

Payments can be made for free, however business will have to pay a processing fee when receiving payments. The system will be secured with either a six-digit PIN or through fingerprint verification.

Image Credit: WhatsApp

The company released a statement about the launch, “The over 10 million small and micro businesses are the heartbeat of Brazil’s communities. It’s become second nature to send a zap to a business to get questions answered. Now in addition to viewing a store’s catalog, customers will be able to send payments for products as well.”

Users can access the feature by liking their WhatsApp with a credit or debit account, made possible through partnerships between WhatsApp and Brazilian financial institutions including Banco do Brasil, Nubank, as well as Sicredi.

Payments can be made for free, however business will have to pay a processing fee when receiving payments. The system will be secured with either a six-digit PIN or through fingerprint verification.

Image Credit: WhatsApp

Trend Themes

1. In-app Payments - Companies can explore integrating in-app payment systems in their messaging apps to enhance the user experience and provide a more seamless payment process.

2. Partnerships with Financial Institutions - Businesses can form partnerships with financial institutions to offer convenient payment options to their customers and expand their reach.

3. Mobile Payment Technology - Mobile payment technology continues to disrupt the way businesses operate by enabling secure and efficient payment transactions through mobile devices.

Industry Implications

1. Financial Services - Financial services institutions can leverage messaging apps to offer quick and easy account access, in-app payments, and other value-added services to their customers.

2. Retail - Retailers can integrate in-app payment options into their messaging apps to enable seamless transactions and boost customer engagement and loyalty.

3. Telecommunications - Telecommunications companies can incorporate in-app payment systems into their messaging apps to expand their service offerings and increase customer retention.

3.1

Score

Popularity

Activity

Freshness