Greengage Debuts a E-Money Service for Businesses to Handle Money Easily

References: greengage.co & thepaypers

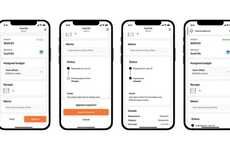

Greengage, a merchant banking provider, has announced the debut of its e-money service. This service is targeted towards digital assets corporations, businesses, and SMEs.

The e-money system is supposed to allow customers to electronically store, manage, and transfer funds. The business anticipates that by providing this service, it will be able to constantly provide its customers that have trouble finding accounts and the right goods from conventional banking solutions and tools with better services. Greengage previously provided its clients with a survey to understand how it could better serve them.

This includes difficulties like attempting to get banking services from significant banks as a firm engaged in crypto-assets. Businesses also won't have to opt for foreign accounts or pay additional fees in order to get the items they want.

Image Credit: Roman Samborskyi

The e-money system is supposed to allow customers to electronically store, manage, and transfer funds. The business anticipates that by providing this service, it will be able to constantly provide its customers that have trouble finding accounts and the right goods from conventional banking solutions and tools with better services. Greengage previously provided its clients with a survey to understand how it could better serve them.

This includes difficulties like attempting to get banking services from significant banks as a firm engaged in crypto-assets. Businesses also won't have to opt for foreign accounts or pay additional fees in order to get the items they want.

Image Credit: Roman Samborskyi

Trend Themes

1. E-money Services for Smes - The emergence of e-money services targeted towards SMEs presents an opportunity for disruptive innovation in the financial services industry.

2. Digital Asset Banking Solutions - The development of specific banking solutions for firms engaged in crypto-assets presents an opportunity for disruptive innovation in the banking industry.

3. Convenient Fund Management Services - The growth of convenient fund management services presents an opportunity for disruptive innovation in the financial technology industry.

Industry Implications

1. Financial Services - The emergence of e-money services and convenient fund management presents opportunities for disruptive innovation in the financial services industry.

2. Banking - The development of digital asset banking solutions presents an opportunity for disruptive innovation in the banking industry.

3. Cryptocurrency - The emergence of e-money services targeted towards digital assets corporations presents an opportunity for disruptive innovation in the cryptocurrency industry.

1.8

Score

Popularity

Activity

Freshness