'Finch' Brings a Social Aspect to Consumer Finances

Michael Hemsworth — September 14, 2017 — Lifestyle

'Finch' is a new fintech app that looks to bring a social aspect to consumer finances to help acknowledge the changing framework for young individuals and their spending.

Money and finances have changed dramatically over the course of the past several years with a shift towards digital inherently evident. 'Finch' looks to incorporate a more social aspect for young users to let them split bills, send and request money, and much more while also offering access to spending habit insights to see where changes could or should be made.

Consumer finances can be something of a mystery for young consumers who view money and their personal finances as somewhat abstract topics. This is being acknowledged by brands with solutions like the 'Finch' app that bring a social experience to finances for enhanced control.

Money and finances have changed dramatically over the course of the past several years with a shift towards digital inherently evident. 'Finch' looks to incorporate a more social aspect for young users to let them split bills, send and request money, and much more while also offering access to spending habit insights to see where changes could or should be made.

Consumer finances can be something of a mystery for young consumers who view money and their personal finances as somewhat abstract topics. This is being acknowledged by brands with solutions like the 'Finch' app that bring a social experience to finances for enhanced control.

Trend Themes

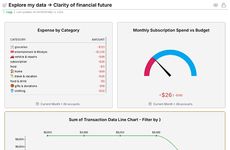

1. Social Finance Management - Fintech apps can include social features for users to better manage expenses and share within their social circles for more transparency.

2. Insightful Spending - Digital finance solutions like 'Finch' can provide personalized insight into consumer spending habits, leading to better financial decision-making and planning.

3. Personalized Finance - Young consumers can leverage personalized finance solutions like 'Finch' to take control of their finances with social features and tools for budgeting, saving, and spending.

Industry Implications

1. Fintech - Fintech companies can develop more personalized finance management apps with social features that cater to younger consumers and provide more insights into their spending habits.

2. Social Networking - Social networking platforms can expand their services to include financial management tools and features that cater to younger audiences and their social circles.

3. Banking - Traditional banks can adopt social and personalized features like those on 'Finch' to cater to younger customers and compete with fintech companies in the digital finance space.

3.1

Score

Popularity

Activity

Freshness