This App Changes the Concept of Collections by Educating Consumers

Katherine Pendrill — October 5, 2015 — Tech

References: payswag & bankdirector

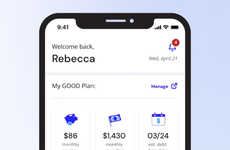

'PaySwag' is a mobile payment platform that aims to change the concept of collections. For many consumers, a lack of financial education can lead to debt and bad credit. This app works in tandem with lenders and other debt-collecting agencies to help minimize defaults and remove the stigma surrounding collections.

PaySwag operates as a mobile payment platform for high-risk borrowers who struggle to make their payments. Unlike other companies, PaySwag uses a gamified platform to change the concept of collections. The app rewards good behavior, which helps consumers make payments on time, minimize defaults and reduce the negativity surrounding collections. The app also promotes financial literacy by encouraging consumers to watch educational videos. Over time, good behaviour can translate into small rewards such as gift cards. The app ultimately helps consumers establish good financial habits and avoid late payments.

The app is ideal for those who continue to struggle with delinquencies and the issue of collections.

PaySwag operates as a mobile payment platform for high-risk borrowers who struggle to make their payments. Unlike other companies, PaySwag uses a gamified platform to change the concept of collections. The app rewards good behavior, which helps consumers make payments on time, minimize defaults and reduce the negativity surrounding collections. The app also promotes financial literacy by encouraging consumers to watch educational videos. Over time, good behaviour can translate into small rewards such as gift cards. The app ultimately helps consumers establish good financial habits and avoid late payments.

The app is ideal for those who continue to struggle with delinquencies and the issue of collections.

Trend Themes

1. Gamification of Payment Apps - There is an opportunity for companies to use gamification in their payment apps to incentivize good financial habits and reduce defaults.

2. Financial Education - Integrating financial education into payment apps can help consumers establish good financial habits and avoid late payments.

3. Partnerships with Debt-collecting Agencies - Payment app companies can partner with debt-collecting agencies to help minimize defaults and remove the stigma surrounding collections.

Industry Implications

1. Financial Services - Financial services companies can integrate gamification and financial education into their payment apps to provide a more engaging customer experience and reduce defaults.

2. Debt Collection - Debt collection agencies can partner with payment app companies to provide a more seamless payment process for high-risk borrowers and help minimize defaults.

3. Mobile App Development - Mobile app developers can focus on creating payment apps that integrate financial education and gamification to make the payment process more fun and engaging for users.

0.8

Score

Popularity

Activity

Freshness