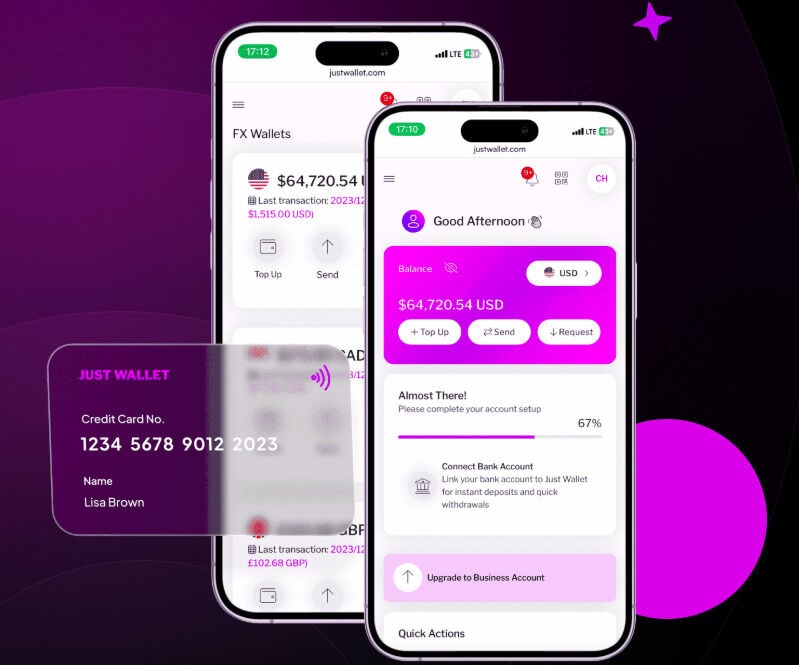

Just Wallet Secures, Low-Cost Global Payments with Revenue Share Options

Ellen Smith — February 10, 2025 — Tech

References: justwallet

Just Wallet is a payment solution designed for fast, secure, and low-cost global transactions. It allows individuals and businesses to send and receive funds instantly, irrespective of location, offering a seamless financial experience. The platform also offers white-label payment solutions and merchant accounts for brands, providing customizable options for integrating payment processing into their operations.

Additionally, Just Wallet includes revenue-sharing opportunities, giving businesses the chance to generate income through their payment systems. This makes it an attractive option for companies seeking cost-effective ways to handle cross-border payments and build monetizable payment infrastructure. With its emphasis on security, low fees, and customizable solutions, Just Wallet is particularly useful for businesses in e-commerce, tech, and global markets, offering a competitive edge in the increasingly digital and interconnected economy.

Image Credit: Just Wallet

Additionally, Just Wallet includes revenue-sharing opportunities, giving businesses the chance to generate income through their payment systems. This makes it an attractive option for companies seeking cost-effective ways to handle cross-border payments and build monetizable payment infrastructure. With its emphasis on security, low fees, and customizable solutions, Just Wallet is particularly useful for businesses in e-commerce, tech, and global markets, offering a competitive edge in the increasingly digital and interconnected economy.

Image Credit: Just Wallet

Trend Themes

1. Instant Global Transactions - The rise of instant global transactions offers a faster financial exchange, reducing barriers associated with time zones and traditional banking delays.

2. Customizable Payment Platforms - Customizable payment platforms empower businesses to tailor payment processing systems, fostering brand loyalty and operational efficiency.

3. Revenue-sharing Payment Models - Revenue-sharing payment models emerge as a novel way for companies to monetize payment infrastructure, creating new revenue streams.

Industry Implications

1. E-commerce - The e-commerce industry benefits from integrated payment solutions, simplifying transactions and expanding market reach globally.

2. Financial Technology (fintech) - The FinTech industry leverages digital payment solutions to innovate financial services, enhancing user experience and security.

3. Global Markets - Global markets are increasingly relying on seamless cross-border transactions to facilitate business operations and international trade.

7.7

Score

Popularity

Activity

Freshness