The Bunq Travel Card Receives Updates for Analytics and Group Payments

Daniel Johnson — September 4, 2019 — Business

References: bunq & techcrunch

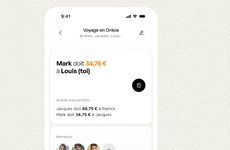

The Bunq Travel Card will receive a number of updates, which include streamlined group payment and analytic tools. Bunq Travel Card owners have been able to share accounts with the Slice groups feature, however, customers had to manually add others for each transaction. The new AutoSlice features will allow customers to add multiple transactions to a SliceGoup. This new feature will help the service create an easier experience for sharing expenses.

Bunq insights are the other new feature, and it will provide customers with the ability to use analytics to track their spending habits. Payments will be categorized automatically, which will allow users to create and view breakdowns of spending.

The two new features will enhance the customer experience for owners of the Bunk card.

Image Credit: Bunq

Bunq insights are the other new feature, and it will provide customers with the ability to use analytics to track their spending habits. Payments will be categorized automatically, which will allow users to create and view breakdowns of spending.

The two new features will enhance the customer experience for owners of the Bunk card.

Image Credit: Bunq

Trend Themes

1. Streamlined Group Payments - Disruptive innovation opportunity: Develop a mobile payment app that allows for seamless group payments, eliminating the need for manual transaction additions.

2. Analytics-based Spending Tracking - Disruptive innovation opportunity: Create a personal finance app that utilizes advanced analytics to automatically categorize and breakdown user spending, giving them valuable insights into their financial habits.

3. Enhanced Customer Experience with Payment Cards - Disruptive innovation opportunity: Design a payment card that offers a range of features like streamlined group payments and spending analytics, to provide customers with a more convenient and personalized experience.

Industry Implications

1. Mobile Payment Apps - Disruptive innovation opportunity: Incorporate streamlined group payment features into existing mobile payment apps to make splitting expenses easier.

2. Personal Finance Apps - Disruptive innovation opportunity: Develop a personal finance app with advanced analytics capabilities to help individuals better understand and manage their spending habits.

3. Payment Card Technology - Disruptive innovation opportunity: Introduce payment cards that offer enhanced features like group payment functionality and spending analytics to improve the overall customer experience.

2.7

Score

Popularity

Activity

Freshness