The 'Barclays Access' Bank Technology Improves Accessibility for Customers

Laura McQuarrie — December 3, 2014 — Tech

References: newsroom.barclays & engadget

Having implemented ways for customers to transfer cash using only their mobile number and setting up authentication codes for fingerprint scanners in the past, and now, experimenting with the use of Beacons in its branches, Barclays has proved that it's always on the forefront of bank technology.

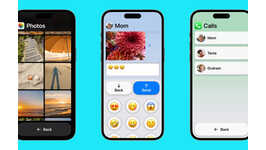

The bank is now testing a service called Barclays Access, which will notify a staff member when a customer in need of accessibility aid enters the branch through the use of iBeacon technology. Rather than having to verbally repeat these needs every time a customer enters the branch, this app makes it so that they can opt-in one time by providing details through an app. The app also makes it so that a photo can be uploaded, so that the customer can easily be identified when they enter the branch by the staff member at the front desk with an iPad.

The bank is now testing a service called Barclays Access, which will notify a staff member when a customer in need of accessibility aid enters the branch through the use of iBeacon technology. Rather than having to verbally repeat these needs every time a customer enters the branch, this app makes it so that they can opt-in one time by providing details through an app. The app also makes it so that a photo can be uploaded, so that the customer can easily be identified when they enter the branch by the staff member at the front desk with an iPad.

Trend Themes

1. Mobile Banking Accessibility - Developing banking apps that improve accessibility for customers with disabilities by using technologies like iBeacon.

2. Personalized Customer Service - Creating apps that allow customers to provide their needs and preferences once, so staff members can easily identify and assist them in the future.

3. Facial Recognition Technology - Exploring the use of apps that utilize facial recognition to easily identify customers with disabilities when they enter a bank branch.

Industry Implications

1. Banking - Banks can innovate by developing assistive banking apps that improve accessibility and personalize customer service.

2. Technology - Technology companies can develop facial recognition apps and iBeacon solutions to enhance accessibility and improve customer experience in the banking industry.

3. Customer Service - Companies specializing in customer service can create apps that streamline the identification and assistance process for customers with disabilities in various industries, including banking.

3.8

Score

Popularity

Activity

Freshness