UK Bank NatWest Uses AI so Customers Can Open Accounts with Selfies

Grace Mahas — July 18, 2019 — Tech

References: personal.natwest & theguardian

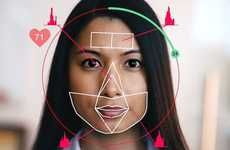

UK-based bank NatWest recently announced that customers can now open their banking accounts using a selfie. The major high street bank partnered with HooYu, an ID verification company, to confirm the identity of the applicant with images from authenticated ID documents such as a passport or driver's license.

This new launch makes banking more efficient for consumers by removing the need for them to physically visit a branch. The process uses state-of-the-art artificial intelligence that can accurately conduct a biometric verification of identities in real-time. Thus far, the system has been successfully piloted with over 60,000 customers and will launch nationwide shortly.

NatWest is not the only bank that allows consumers banking access through a selfie -- Metro Bank and digital banks Monzo and Starling have also harnessed AI identity authentication to allow customers remote baking access.

This new launch makes banking more efficient for consumers by removing the need for them to physically visit a branch. The process uses state-of-the-art artificial intelligence that can accurately conduct a biometric verification of identities in real-time. Thus far, the system has been successfully piloted with over 60,000 customers and will launch nationwide shortly.

NatWest is not the only bank that allows consumers banking access through a selfie -- Metro Bank and digital banks Monzo and Starling have also harnessed AI identity authentication to allow customers remote baking access.

Trend Themes

1. Selfie Banking Access - Facial recognition technology is enabling new banking channels that allow customers to open accounts and access banking services using a selfie, reducing the need for manual verification.

2. Real-time ID Verification - State-of-the-art artificial intelligence enables real-time biometric verification of customer identities to reduce fraud and enhance customer experience.

3. Remote Banking Services - With digital innovation and AI-enabled identity verification, banking services can now be offered remotely, providing financial access to a wider audience.

Industry Implications

1. Banking - The banking industry can leverage facial recognition technology for more efficient and secure services, expanding beyond traditional brick-and-mortar branches.

2. ID Verification - ID verification companies can partner with banks to offer more streamlined and automated verification processes that increase accuracy and reduce manual effort.

3. Digital Banking - Digital banks can lead the way in providing unparalleled customer experiences by adopting cutting-edge technology, like facial recognition technology, for improved financial access.

3.5

Score

Popularity

Activity

Freshness