Absa Bank Tanzania Unveils a New Youth Savings Account

References: absa.co.tz & ippmedia

Absa Bank Tanzania is committed to creating new financial pathways for young adults. The bank's new Youth Savings Account, marketed toward individuals 18-30, provides customers with a reliable tool for building savings. To open the Youth Savings Account, customers are required to make an initial deposit of 1,000/-. The account features tiered monthly interest rates ranging from four to six percent, with the rate offered depending on the amount deposited and the length of the deposit period.

“We are introducing an innovative product which targets young individuals aged 18 to 30, a demographic that represents a significant portion of Tanzania’s population,” said Ndabu Swere, Head of Retail Banking at Absa Bank Tanzania.

This initiative hopes to support young adults who need a reliable foundation for improving their financial standings.

Image Credit: IPP Media, The Guardian

“We are introducing an innovative product which targets young individuals aged 18 to 30, a demographic that represents a significant portion of Tanzania’s population,” said Ndabu Swere, Head of Retail Banking at Absa Bank Tanzania.

This initiative hopes to support young adults who need a reliable foundation for improving their financial standings.

Image Credit: IPP Media, The Guardian

Trend Themes

1. Youth-oriented Financial Products - Banks are increasingly designing financial products aimed at young adults, such as savings accounts with tiered interest rates, to foster early financial responsibility.

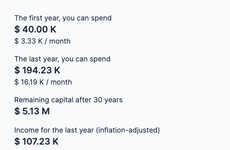

2. Tiered Interest Rate Structures - Implementing tiered interest rate structures in savings accounts offers higher returns for larger and longer deposits, incentivizing consistent saving habits among users.

3. Inclusive Banking Initiatives - Financial institutions are launching inclusive banking services that cater to underbanked demographics, specifically targeting young adult users with age-specific savings products.

Industry Implications

1. Retail Banking - Retail banking is focusing on developing specialized financial products for younger customers to build long-term relationships and promote financial literacy.

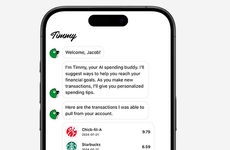

2. Fintech Solutions - Fintech companies are providing innovative platforms that support targeted savings accounts, making it easier for young adults to manage and grow their finances through technology.

3. Educational Programs - Educational programs are being integrated with financial services to offer young adults the tools and knowledge needed to maximize their savings and financial planning.

5.8

Score

Popularity

Activity

Freshness