Venmo Announced It Will Launch Its First Credit Card in 2020

Grace Mahas — October 17, 2019 — Business

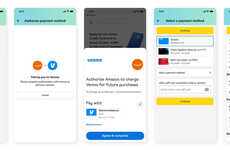

Venmo, the mobile payment service owned by PayPal that easily lets users make and share payments with friends, recently announced the launch of its first-ever credit card thanks to Venmo's expanded relationship with Synchrony. Synchrony's cutting-edge technology -- including program management and data analytics -- will give Venmo credit card users a personalized shopping and payment plan and new ways to interact with joint purchases.

The new credit card will cater to Millennials who "are looking for leading-edge digital capabilities like around-the-clock access, personalization, simple but powerful mobile apps with granular controls and alerts, and rewards." Venmo has already mastered many of these aspects -- which is what gave the brand its huge brand following with Millenials -- however, we can expect consumer loyalty to increase with the credit card launch.

Image Credit: Shutterstock

The new credit card will cater to Millennials who "are looking for leading-edge digital capabilities like around-the-clock access, personalization, simple but powerful mobile apps with granular controls and alerts, and rewards." Venmo has already mastered many of these aspects -- which is what gave the brand its huge brand following with Millenials -- however, we can expect consumer loyalty to increase with the credit card launch.

Image Credit: Shutterstock

Trend Themes

1. Mobile Payment Credit Cards - With the growing trend of mobile payments, there is an opportunity for more financial institutions to offer seamless and personalized credit card solutions through mobile apps.

2. Personalized Payment Plans - The use of data analytics technology allows for more tailored payment plans and rewards programs, creating a disruptive opportunity for credit card companies to increase customer loyalty.

3. Digital Capabilities - Consumer demand for digital capabilities provides an opportunity for companies to offer simple but powerful mobile apps with granular controls and alerts for credit card usage.

Industry Implications

1. Financial Services - The financial services industry has the opportunity to enhance their mobile apps and credit card offerings to appeal to Millennials and increase customer loyalty with personalized payment solutions and digital capabilities.

2. Data Analytics - With the use of data analytics technology, there is a disruptive opportunity for industries to tailor payment and rewards programs for credit card holders, leading to increased customer satisfaction and loyalty.

3. Retail - Retailers have the chance to partner with credit card companies to create joint purchase options and other innovative shopping and payment experiences for their customers.

2.3

Score

Popularity

Activity

Freshness