The Uni-Verse is a Banking Metaverse for Union Bank of India Clients

Colin Smith — August 4, 2022 — Tech

References: unionbankofindia.co.in & outlookindia

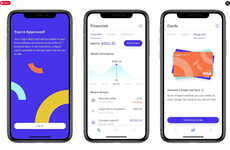

The Union Bank of India (UBI) announced a new virtual banking project titled the 'Uni-Verse.' The UBI is creating the Uni-Verse through a direct collaboration with 'Tech Mahindra,' a multinational information technologies company. At its core, the Uni-Verse will be a traversable virtual environment that allows clients of the UBI to perform each task that they would typically travel to a physical bank for.

The UBI is aiming to take the Uni-Verse beyond the scope of simply a virtual bank, though, as the Government organization aims to connect with the younger population on a deeper level through the convenience of the metaverse. As such, the UBI will host a variety of workshops, talks, and conferences in the Uni-Verse. These talks will focus on important finance-related topics such as savings, investments, loans, welfare, and more.

Two of the core perks of banking in the metaverse, according to the UBI, are swiftness and safety. Each customer will be validated extensively before banking tasks are performed, and clients will have constant, quick access to their banking accounts and services.

Image Credit: Shutterstock

The UBI is aiming to take the Uni-Verse beyond the scope of simply a virtual bank, though, as the Government organization aims to connect with the younger population on a deeper level through the convenience of the metaverse. As such, the UBI will host a variety of workshops, talks, and conferences in the Uni-Verse. These talks will focus on important finance-related topics such as savings, investments, loans, welfare, and more.

Two of the core perks of banking in the metaverse, according to the UBI, are swiftness and safety. Each customer will be validated extensively before banking tasks are performed, and clients will have constant, quick access to their banking accounts and services.

Image Credit: Shutterstock

Trend Themes

1. Virtual Banking Platforms - Opportunities for creating virtual banking platforms that offer clients the ease of performing banking tasks from anywhere.

2. Metaverse Events - Opportunities for hosting talks, workshops and conferences virtually in the metaverse.

3. Enhanced Security Validation - Opportunities for enhanced security validation for online banking tasks, in the metaverse and beyond.

Industry Implications

1. Banking - Opportunities for banks to leverage virtual environments and offer clients swiftness and safety in performing banking tasks in the metaverse.

2. Information Technologies - Opportunities for IT companies to partner with banks and create innovative virtual banking platforms and experiences.

3. Events and Conferences - Opportunities for events and conferences industry to expand into the metaverse and offer alternative, more inclusive, and accessible options for their attendees.

6.3

Score

Popularity

Activity

Freshness