Splitting the Bill is Easy Thanks to GrubHub and Venmo

Ellen Smith — April 25, 2018 — Lifestyle

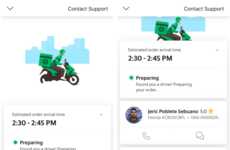

Now splitting the bill is as easy as ordering takeout thanks to GrubHub and its new partnership with the money-sending app Venmo.

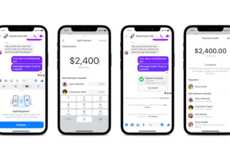

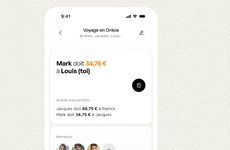

Through GrubHub, users will be able to send requests to friends asking for the money the owe for their portion of the ordered food. This streamlined experience cuts out the extra steps that's typically involved in splitting delivery bills, like wiring money or heading to an ATM. The new service only works if both parties have both apps installed on their phones.

This offer is additionally available through Seamless or Eat24, as both are owned by GrubHub. This partnership takes the hassle out of ordering food with friends and creates a more streamlined service.

Image Credit: GrubHub

Through GrubHub, users will be able to send requests to friends asking for the money the owe for their portion of the ordered food. This streamlined experience cuts out the extra steps that's typically involved in splitting delivery bills, like wiring money or heading to an ATM. The new service only works if both parties have both apps installed on their phones.

This offer is additionally available through Seamless or Eat24, as both are owned by GrubHub. This partnership takes the hassle out of ordering food with friends and creates a more streamlined service.

Image Credit: GrubHub

Trend Themes

1. Bill-splitting Food Delivery - The practice of splitting bills for food delivery orders is increasingly becoming common thanks to the introduction of partnerships such as between GrubHub and Venmo.

2. Peer-to-peer Payment Systems - Peer-to-peer payment systems such as Venmo are disrupting traditional payment systems by making it easier to split bills and make payments on the go.

3. Streamlined User Experience - The integration of GrubHub and Venmo enables a more streamlined experience for food delivery and bill splitting for users.

Industry Implications

1. Food Delivery - The food delivery industry can leverage partnerships such as GrubHub and Venmo to improve user experience and tap into new markets.

2. Mobile Payment - Mobile payment technology providers such as Venmo and PayPal are disrupting the traditional payment landscape with their easy-to-use and on-the-go payment systems.

3. Financial Technology (fintech) - Fintech companies are driving innovation in payments, including the introduction of new services that are transforming the way consumers transact and manage their money.

1.1

Score

Popularity

Activity

Freshness