The SCENE Bundle Lets Consumers Get All Their Banking in One Place

References: scotiabank

For a lot of people, finances are the last thing they want to think about, and the SCENE Bundle from Scotiabank is a great way to tackle several financial responsibilities at the same time. Not only does the SCENE Bundle give consumers a base of banking and finance products, but it also provides a host of convenient benefits.

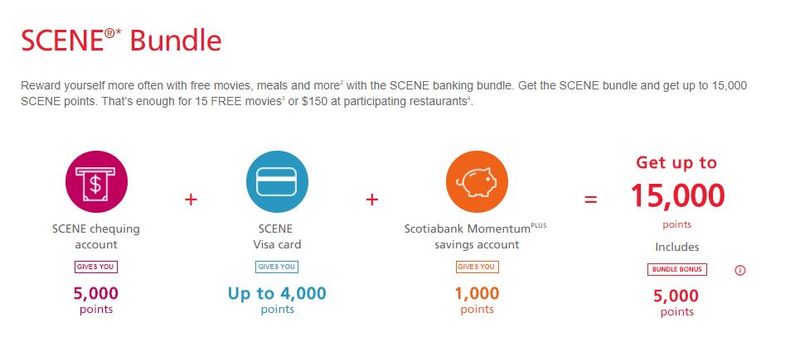

Scotiabank's bundled product includes a SCENE chequing account, a SCENE Visa card, and a Scotiabank Momentum savings account. Each of those products on their own provides consumers with points that they can contribute towards things like movies or meals, but when purchased together, they give consumers a bonus of 5,000 SCENE points — which is equivalent to 50 percent of the points from all the products alone.

Scotiabank's bundled product includes a SCENE chequing account, a SCENE Visa card, and a Scotiabank Momentum savings account. Each of those products on their own provides consumers with points that they can contribute towards things like movies or meals, but when purchased together, they give consumers a bonus of 5,000 SCENE points — which is equivalent to 50 percent of the points from all the products alone.

Trend Themes

1. Bundled Financial Products - Scotiabank's SCENE Bundle shows potential for a trend towards packaged financial services.

2. Points-based Rewards Programs - The combination of points-based rewards with financial products may be a growing trend in the banking industry.

3. Convenience Services - The SCENE Bundle highlights an increasing demand for convenient and accessible financial services.

Industry Implications

1. Banking - The SCENE Bundle demonstrates a potential area for disruption in the banking industry through bundled financial services.

2. Entertainment - The use of a rewards system that can be redeemed for movies or meals may disrupt rewards programs in the entertainment industry.

3. Technology - The rise of fintech companies and digital banking options may increase competition in the convenient financial services industry.

0.5

Score

Popularity

Activity

Freshness