Dyme Helps Users Save Up for Long and Short-Term Goals

Jana Pijak — October 5, 2015 — Tech

References: dyme.co

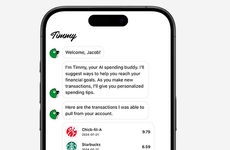

Learning how to be financially responsible can be a difficult feat for many and savings platform Dyme aims to change bad habits with tools that help users save for long and short-term goals.

Whether saving for a car, an engagement ring or retirement, users will be encouraged to become more financially responsible when using this convenient service. The text-based platform is ideal for small business owners who are looking to boost their start-up while making the most of their income.

For those looking to retire early, Dyme offers features like financial goal countdowns and rewards users for texting -- a task they will likely perform on a daily basis. Moreover, the savings platform reminds mobile users to contribute to specific accounts and makes planning for the future easy for those who are overwhelmed with financial responsibilities.

Whether saving for a car, an engagement ring or retirement, users will be encouraged to become more financially responsible when using this convenient service. The text-based platform is ideal for small business owners who are looking to boost their start-up while making the most of their income.

For those looking to retire early, Dyme offers features like financial goal countdowns and rewards users for texting -- a task they will likely perform on a daily basis. Moreover, the savings platform reminds mobile users to contribute to specific accounts and makes planning for the future easy for those who are overwhelmed with financial responsibilities.

Trend Themes

1. Text-powered Savings Platforms - Dyme showcases the trend of using text-based platforms to encourage financial responsibility and savings for various goals.

2. Financial Goal Countdowns - Dyme taps into the trend of using countdowns to motivate users in achieving their financial goals.

3. Rewarding Users for Texting - Dyme capitalizes on the trend of incentivizing users by offering rewards for regular texting.

Industry Implications

1. Personal Finance - Dyme revolutionizes the personal finance industry by providing a convenient and motivating text-based savings platform.

2. Start-up Support - Dyme disrupts the start-up support industry by empowering small business owners to boost their ventures through effective income management.

3. Mobile Money Management - Dyme pioneers the mobile money management industry by simplifying financial planning and goal tracking for overwhelmed individuals.

1.4

Score

Popularity

Activity

Freshness