Republic Realm is a Hyper-Exclusive Real Estate Investment Fund

References: republicrealm

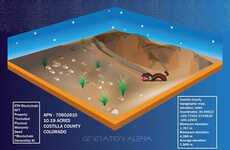

Republic Realm is on the pulse of the current moment; it is a digital real estate NFT investment fund that is professionally managed and invitation-only, with a current maximum of 99 accredited investors. This venture stems from the popularity of decentralized virtual worlds and as people spend more time in digital environments—whether it is for work or leisure—a new vibrant digital real estate market is being created.

Republic Realm is focused "on the acquisition, management, development, and sale of virtual land across existing metaverses including Decentraland, the first and most established multiplayer role-playing metaverse built on the Ethereum blockchain." For those unfamiliar with the concept, investment in digital real estate warrants the purchase and exchange of non-fungible tokens (NFTs) which have been enthusiastically covered by the media recently.

Image Credit: Republic Realm

Republic Realm is focused "on the acquisition, management, development, and sale of virtual land across existing metaverses including Decentraland, the first and most established multiplayer role-playing metaverse built on the Ethereum blockchain." For those unfamiliar with the concept, investment in digital real estate warrants the purchase and exchange of non-fungible tokens (NFTs) which have been enthusiastically covered by the media recently.

Image Credit: Republic Realm

Trend Themes

1. NFT Investment Funds - As the popularity of decentralized virtual worlds increases, professionally managed NFT investment funds for digital real estate offer a disruptive innovation opportunity.

2. Digital Real Estate Market - The emergence of a vibrant digital real estate market as people spend more time in digital environments creates disruptive innovation opportunities for virtual land acquisition, management, development, and sale.

3. Virtual Land Acquisition Via Nfts - The purchase and exchange of non-fungible tokens (NFTs) for virtual land acquisition offer disruptive innovation opportunities as investment in digital real estate gains popularity.

Industry Implications

1. Finance - Finance industry can leverage professionally managed NFT investment funds for digital real estate and extend their financial services to accredited investors in need of new investment options.

2. Blockchain - Blockchain industry can take advantage of the emergence of a vibrant digital real estate market by providing improved blockchain-based platforms for virtual land acquisition, management, development, and sale.

3. Gaming - Gaming industry can collaborate with digital real estate investment funds to develop digital environments that offer multiplayer role-playing experiences and leverage NFTs for virtual land acquisition and development.

5.9

Score

Popularity

Activity

Freshness