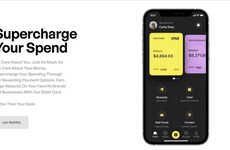

The 'Point' Debit Card Lets Users Collect Points without a Credit Card

Michael Hemsworth — March 13, 2019 — Tech

References: trypointbank & betalist

The 'Point' debit card is positioned as the first debit card that will provide users with access to reward points, which has previously only been available with credit cards. The digital bank will reward shoppers with twice the points and cash back for every dollar that they spend eating out, traveling and more. The bank also doesn't charge any overdraft fees, require a minimum balance, or charge foreign transaction fees -- making it a truly travel-friendly option for consumers.

The 'Point' debit card and digital bank are a more savvy service for consumers that addresses the need for more control and rewards, while also eliminating fees. This helps to draw in younger demographics like Millennials, who are looking for more lifestyle and savings-focused financial products.

The 'Point' debit card and digital bank are a more savvy service for consumers that addresses the need for more control and rewards, while also eliminating fees. This helps to draw in younger demographics like Millennials, who are looking for more lifestyle and savings-focused financial products.

Trend Themes

1. Debit Card Rewards - The 'Point' debit card introduces a new trend of allowing users to collect reward points without needing a credit card.

2. Travel-friendly Banking - The 'Point' digital bank disrupts the industry by not charging any overdraft fees, requiring a minimum balance, or charging foreign transaction fees, making it a convenient option for travelers.

3. Lifestyle and Savings-focused Financial Products - The 'Point' debit card and digital bank target younger demographics by offering rewards and savings features that align with their lifestyle choices and financial goals.

Industry Implications

1. Banking - The banking industry can explore incorporating debit card reward programs to attract and retain customers who prefer using debit cards over credit cards.

2. Fintech - Fintech companies can develop innovative solutions to enhance the travel-friendliness of banking services, such as eliminating fees and offering flexible transaction options.

3. Retail - Retailers can collaborate with debit card reward programs to provide exclusive perks and discounts to customers, boosting customer loyalty and driving sales.

2.7

Score

Popularity

Activity

Freshness