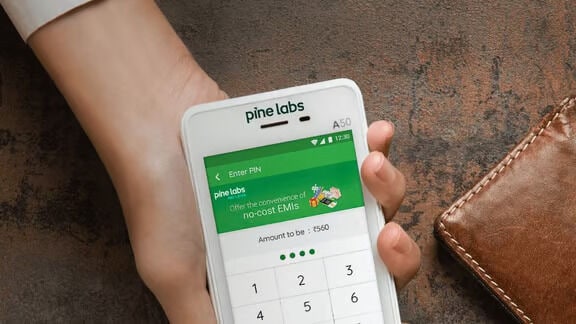

Pine Labs Unveils the New UPISetu Product for Merchant UPI Payments

References: pinelabs & ndtvprofit

Pine Labs has recently unveiled its latest innovation, UPISetu, a comprehensive product focused on enhancing Unified Payments Interface (UPI) transactions. This new offering, developed by Setu—an affiliate of Pine Labs—offers new possibilities in digital payments, thanks to a strategic partnership with Axis Bank Ltd.

UPISetu is designed to cater to a broad spectrum of UPI functionalities, making it a versatile tool for different payment scenarios. The product supports various payment methods, including QR code payments, which facilitate quick and contactless transactions, and UPI Autopay, which automates recurring payments for added convenience.

Additionally, UPISetu enables the integration of Electronic Money Transfers (EMI), allowing users to manage payments over time, and provides third-party validation services to enhance transaction security and reliability.

Image Credit: Pine Labs

UPISetu is designed to cater to a broad spectrum of UPI functionalities, making it a versatile tool for different payment scenarios. The product supports various payment methods, including QR code payments, which facilitate quick and contactless transactions, and UPI Autopay, which automates recurring payments for added convenience.

Additionally, UPISetu enables the integration of Electronic Money Transfers (EMI), allowing users to manage payments over time, and provides third-party validation services to enhance transaction security and reliability.

Image Credit: Pine Labs

Trend Themes

1. Comprehensive Digital Payments - With UPISetu's ability to support a wide variety of UPI functionalities, businesses have an expanded toolkit for digital transaction options.

2. Automated Recurring Payments - The inclusion of UPI Autopay in UPISetu simplifies and automates recurring payment processes, reducing the need for manual intervention.

3. Enhanced Payment Security - UPISetu's third-party validation services improve transaction security, offering reliable and trustworthy payment solutions.

Industry Implications

1. Digital Banking - The introduction of UPISetu through a partnership with Axis Bank highlights significant advancements in digital banking solutions.

2. Retail Payments - UPISetu's support for QR code payments positions it as a critical tool in the evolving landscape of retail payment methods.

3. Fintech Solutions - As a versatile payment product, UPISetu demonstrates the innovations emerging within the fintech sector.

6.8

Score

Popularity

Activity

Freshness