The New 'Douugh' App Will Offer Consolidated Financial Services

Rahul Kalvapalle — November 30, 2021 — Business

References: railsbank & crowdfundinsider

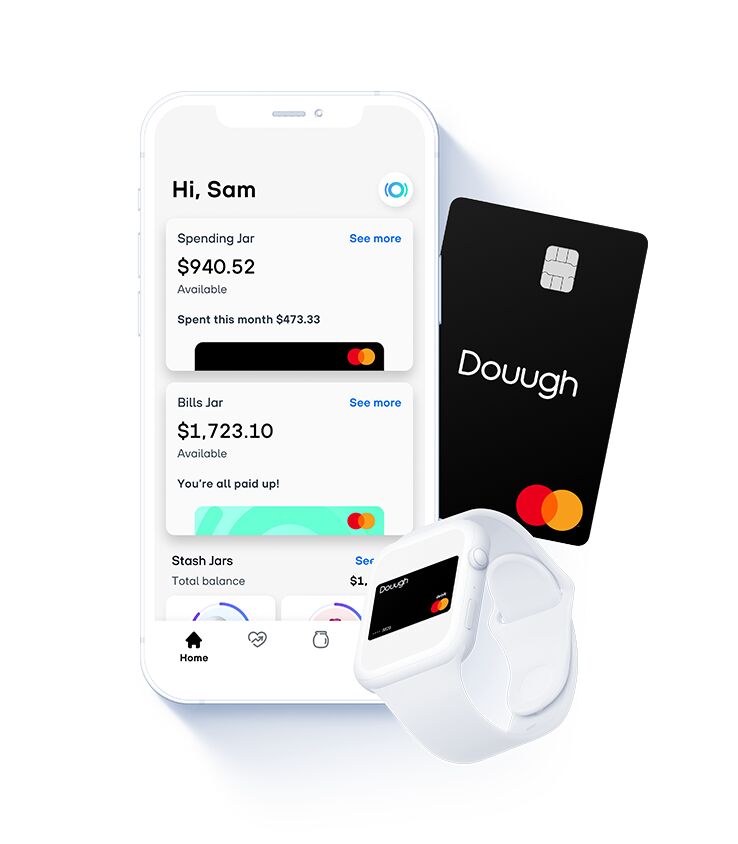

Fintech firm Doough has partnered up with embedded finance company Railsbank to launch an innovative new financial super app that is designed to consolidate a range of financial services ranging from bank accounts and payments to cryptocurrencies and stock market access.

Douugh's financial wellness platform has already made a name for itself by helping customers manage their finances, chip away at their debt and steadily build up their savings. By combining these features with Railsbank's status as a regulated financial institution in the United Kingdom and Europe, the company is looking to provide consolidated financial services to customers.

Set to be launched in Australia, the United Kingdom, Europe and select countries in Southeast Asia, this financial super app speaks to the utility of companies banding together to combine their respective competencies and market advantages in order to provide high-quality services in the fast-growing financial super app space.

Image Credit: Doough

Douugh's financial wellness platform has already made a name for itself by helping customers manage their finances, chip away at their debt and steadily build up their savings. By combining these features with Railsbank's status as a regulated financial institution in the United Kingdom and Europe, the company is looking to provide consolidated financial services to customers.

Set to be launched in Australia, the United Kingdom, Europe and select countries in Southeast Asia, this financial super app speaks to the utility of companies banding together to combine their respective competencies and market advantages in order to provide high-quality services in the fast-growing financial super app space.

Image Credit: Doough

Trend Themes

1. Consolidated Financial Services - The new financial super app offers consolidated financial services, presenting an opportunity for companies to combine their respective competencies and market advantages.

2. Financial Wellness Platforms - Douugh's financial wellness platform has already made a name for itself, setting a trend towards innovative financial wellness platforms.

3. Embedded Finance - The partnership between Douugh and Railsbank shows a trend towards embedded finance in the development of financial super apps.

Industry Implications

1. Fintech - The launch of the innovative financial super app highlights opportunities for disruptive innovation in the fintech industry.

2. Banking - The consolidation of financial services into one app presents an opportunity for disruption in the banking industry.

3. Investment - The inclusion of cryptocurrencies and stock market access in the financial super app presents an opportunity for disruption in the investment industry.

3.9

Score

Popularity

Activity

Freshness