'Amazon Pay Monthly' Entices Shoppers with a Buy Now, Pay Later Option

Laura McQuarrie — April 13, 2016 — Business

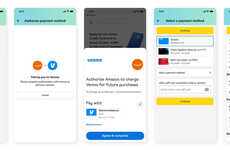

Web shoppers who are spending more than £400 on a single or multiple items are now eligible to take advantage of the Amazon Pay Monthly program via Amazon UK. The friendly, flexible financing solution is being introduced thanks to a partnership with Hitachi Capital, offering a convenient credit option that competes with other retailers.

Eligible users will be offered Amazon Pay Monthly upon checkout and when selected, a credit check is instantly run on users in order to deem if they will be a good candidate for the program. Amazon Pay Monthly charges 16.9% interest.

A representative from Hitachi notes: "It means you can go straight from choosing a new dishwasher or fridge to accessing finance options through us, all while staying on the Amazon site."

Eligible users will be offered Amazon Pay Monthly upon checkout and when selected, a credit check is instantly run on users in order to deem if they will be a good candidate for the program. Amazon Pay Monthly charges 16.9% interest.

A representative from Hitachi notes: "It means you can go straight from choosing a new dishwasher or fridge to accessing finance options through us, all while staying on the Amazon site."

Trend Themes

1. Ecommerce Financing Solutions - Retailers can introduce their own financing solutions for larger purchases to compete with Amazon Pay Monthly and offer customers more payment flexibility.

2. Instant Credit Checks - Incorporating instant credit checks into the checkout process can provide a seamless financing experience for customers and reduce the risk of bad debts for lenders.

3. Partnerships with Financing Providers - Collaborating with financing providers like Hitachi Capital can allow retailers to offer attractive financing options to customers without taking on the financial risk themselves.

Industry Implications

1. Retail - Retail businesses, particularly those with high-priced items, can benefit from introducing financing solutions to increase sales and customer loyalty.

2. Financial Services - Financial institutions can partner with retailers to offer financing solutions and expand their customer base while generating revenue from interest charges.

3. Ecommerce Platforms - Ecommerce platforms can incorporate financing options into their checkout process to attract more customers and increase sales volume.

2.8

Score

Popularity

Activity

Freshness