This Online Payment Platform Lets Businesses Take Money Using $Cashtags

Alyson Wyers — April 11, 2015 — Business

References: cash.me & springwise

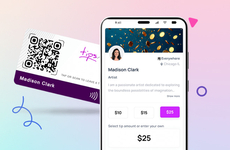

Following the launch of their peer-to-peer online payment platform in 2013, Square Cash is extending their services to businesses too with $Cashtags. Using this new system, any company can take payments immediately from online customers.

$Cashtags consists of a unique identifier that allows brands to obtain payments privately and securely via Square Cash. Businesses create and register their own memorable $Cashtag name using the app or website. From there, they just share it with customers. This could be through business cards, websites, Twitter and other social media platforms or however else is deemed appropriate. Companies pay 1.5% of the transaction. Customers can also use the app or site to make their payments or donations. This suggests in addition to for-profit firms, non-profits and charities as well as artists could use this online payment platform.

$Cashtags consists of a unique identifier that allows brands to obtain payments privately and securely via Square Cash. Businesses create and register their own memorable $Cashtag name using the app or website. From there, they just share it with customers. This could be through business cards, websites, Twitter and other social media platforms or however else is deemed appropriate. Companies pay 1.5% of the transaction. Customers can also use the app or site to make their payments or donations. This suggests in addition to for-profit firms, non-profits and charities as well as artists could use this online payment platform.

Trend Themes

1. Peer-to-peer Payments - The rise of peer-to-peer payment platforms is disrupting the banking and financial industries by shifting control of transactions to consumers.

2. Online Payment Platforms - The growth of online payment platforms is making it easier for businesses to accept payments and expanding opportunities for customers to make purchases and donations online.

3. Social Media Payments - The integration of social media platforms with payment systems is providing new opportunities for businesses to engage with customers and streamline the payment process.

Industry Implications

1. E-commerce - The e-commerce industry has been greatly impacted by the rise of online payment platforms and the ability to accept payments from customers around the world.

2. Non-profits and Charities - The ability to accept mobile and online donations through peer-to-peer payment platforms is allowing non-profit organizations and charities to reach more donors and raise more funds than ever before.

3. Social Media Marketing - The integration of payment platforms with social media channels creates opportunities for businesses to combine marketing efforts with transactions, creating a seamless customer experience.

2.8

Score

Popularity

Activity

Freshness