Hopscotch Enables "Instant, Fee-free Payments for Small Businesses"

References: fastcompany & gohopscotch

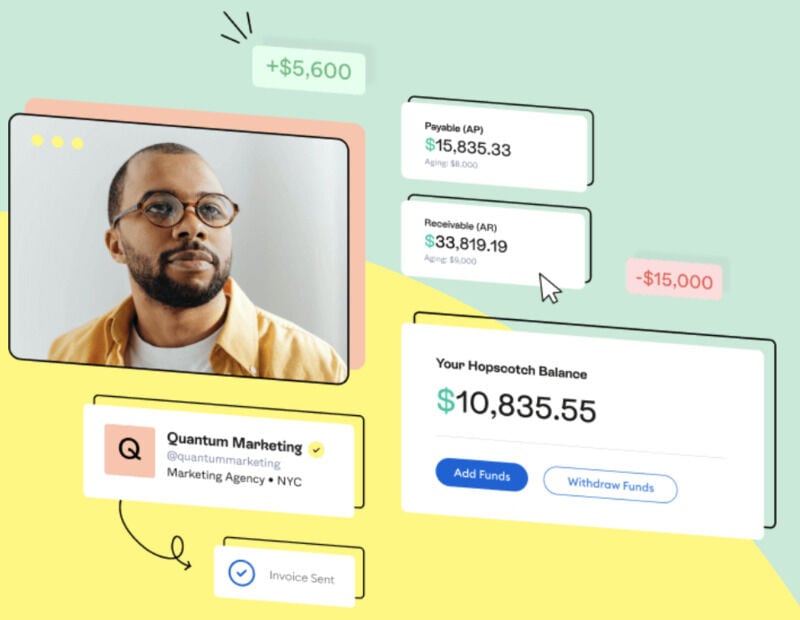

Hopscotch is an all-in-one B2B payment app, co-founded by Reed Switzer who is part of the Gen Z demographic. Geared toward supporting small businesses and freelancers, Hopscotch is a zero-fee platform that is secure, fast, and streamlined. The design is fresh and easy-to-use.

The B2B payment app enables users to auto-generate invoices, send payment reminders, schedule payments, and instantly access money. The platform, thus, actively emphasizes the need for convenience, simplicity and better cash flow with better cash control. Hopscotch includes a smart dashboard with the option for integrations—for example, the B2B payment app can "seamlessly [integrate] with accounting platforms like Quickbooks."

Hopscotch can work for non-users, as well. This means that clients and business partners do not need to sign up for the platform in order t do business.

Image Credit: Hop Scotch

The B2B payment app enables users to auto-generate invoices, send payment reminders, schedule payments, and instantly access money. The platform, thus, actively emphasizes the need for convenience, simplicity and better cash flow with better cash control. Hopscotch includes a smart dashboard with the option for integrations—for example, the B2B payment app can "seamlessly [integrate] with accounting platforms like Quickbooks."

Hopscotch can work for non-users, as well. This means that clients and business partners do not need to sign up for the platform in order t do business.

Image Credit: Hop Scotch

Trend Themes

1. Zero-fee B2B Payment Apps - The rise of zero-fee B2B payment apps that prioritize convenience and simplicity offers an opportunity for disruption in the payments industry.

2. All-in-one B2B Payment Solutions - The development of all-in-one B2B payment solutions that offer a comprehensive suite of features like auto-generated invoices, payment reminders, and instant access to money present an opportunity for providers to distinguish themselves and gain market share.

3. Integration-ready Payment Platforms - The demand for payment platforms that seamlessly integrate with accounting platforms like Quickbooks is growing, creating opportunities for providers to develop customized integrations and capture enterprise customers.

Industry Implications

1. Fintech - Fintech companies can leverage their expertise in payments technology to develop zero-fee, all-in-one payment solutions that cater to the needs of small businesses and freelancers.

2. Accounting - Accounting software companies can expand their offerings by integrating with B2B payment apps that offer convenience, simplicity, and zero fees.

3. Small Business - Small business owners can benefit from the convenience and simplicity of zero-fee B2B payment apps that offer features like auto-generated invoices, payment reminders, and instant access to money.

4.8

Score

Popularity

Activity

Freshness