Wells Fargo's New Virtual Assistant Carries Out Banking Tasks

Rahul Kalvapalle — October 27, 2021 — Business

References: wellsfargo & voicebot.ai

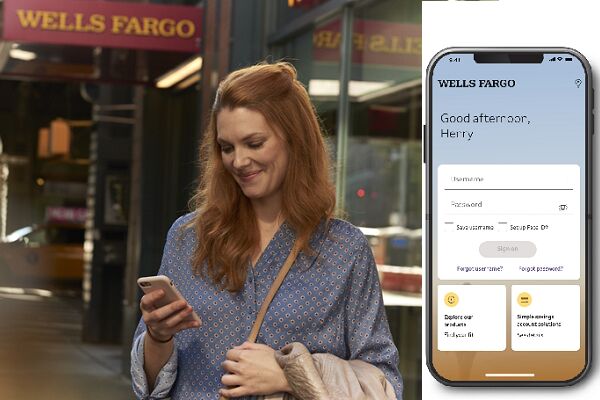

Multinational financial services giant Wells Fargo is launching a brand new virtual assistant that is designed to use the wonders of artificial intelligence and machine learning technologies to provide improved customer service and convenience to customers, particularly users of the company's updated smartphone app.

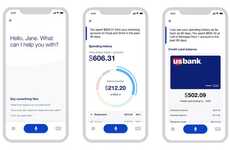

Simply dubbed 'Fargo,' this new virtual assistant will be capable of posing banking-related questions and then performing tasks accordingly. For example, a Wells Fargo client can ask the virtual assistant to transfer money between accounts, pay an outstanding bill, reveal account balances or provide statements of past and pending transactions.

Whilst banking has already long infiltrated mobile platforms, technology continues to evolve at a rapid pace with the advent of new tools such as AI, which is why Wells Fargo is looking to stay ahead of the curve by combining the benefits of AI and virtual assistants.

Image Credit: Wells Fargo

Simply dubbed 'Fargo,' this new virtual assistant will be capable of posing banking-related questions and then performing tasks accordingly. For example, a Wells Fargo client can ask the virtual assistant to transfer money between accounts, pay an outstanding bill, reveal account balances or provide statements of past and pending transactions.

Whilst banking has already long infiltrated mobile platforms, technology continues to evolve at a rapid pace with the advent of new tools such as AI, which is why Wells Fargo is looking to stay ahead of the curve by combining the benefits of AI and virtual assistants.

Image Credit: Wells Fargo

Trend Themes

1. AI-powered Virtual Assistants - New advancements in AI technology are creating opportunities to improve customer experience with virtual assistants in the finance industry.

2. Mobile Banking - Mobile banking continues to evolve with more companies like Wells Fargo incorporating innovative technology to offer enhanced services for clients.

3. Machine Learning Tools for Banking - The use of machine learning technologies in banking tasks is becoming increasingly popular, allowing for more efficient and convenient services for customers.

Industry Implications

1. Finance Industry - The finance industry is actively exploring and adopting new technologies to enhance customer experience, such as AI-powered virtual assistants like ‘Fargo’.

2. Artificial Intelligence Industry - The artificial intelligence industry has the opportunity to create applications like 'Fargo' that addresses specific needs in finance and banking.

3. Mobile App Development Industry - The mobile app development industry has potential to expand their offerings by integrating AI-powered virtual assistants like 'Fargo' into their products.

3

Score

Popularity

Activity

Freshness