The 'Rate My Rate' App Helps You Optimize Your Mortgage Selections

Rahul Kalvapalle — May 27, 2016 — Tech

References: elend & washingtonpost

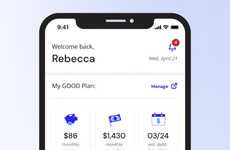

Rate My Rate is an innovative new smartphone app, developed by eLEND (a division of American Financial Resources), that is designed to make it easier than ever for people to access and utilize a tool for the sake of mortgage comparison.

The app is capable of taking into account information from Loan Estimate forms before running that through eLEND's proprietary system in order to come up with innovative and insightful mortgage comparisons that take all variables into account.

Mortgages are rather difficult and complicated to compare for people, particularly those who might be purchasing a home for the first time. This is where Rate My Rate comes in. This app makes mortgage comparison less intimidating and empowers home-buyers to make smart decisions.

The app is capable of taking into account information from Loan Estimate forms before running that through eLEND's proprietary system in order to come up with innovative and insightful mortgage comparisons that take all variables into account.

Mortgages are rather difficult and complicated to compare for people, particularly those who might be purchasing a home for the first time. This is where Rate My Rate comes in. This app makes mortgage comparison less intimidating and empowers home-buyers to make smart decisions.

Trend Themes

1. Mobile Mortgage Comparison - Developing mobile apps that simplify mortgage comparison and empower home-buyers.

2. Data-driven Mortgage Analysis - Utilizing Loan Estimate forms and proprietary systems to provide innovative and insightful mortgage comparisons.

3. Simplifying Home-buying Process - Creating tools that make mortgage comparison less intimidating for first-time home-buyers.

Industry Implications

1. Fintech - Fintech companies can develop mobile apps and platforms for mortgage comparison and analysis.

2. Real Estate - Real estate agencies can integrate mortgage comparison apps into their services to enhance the home-buying process for clients.

3. Technology - Technology companies can provide innovative solutions for simplifying mortgage comparisons and analysis.

2.4

Score

Popularity

Activity

Freshness