MoneyGram Enables Customers to Transfer Money Across the World

Grace Mahas — February 4, 2021 — Tech

References: prnewswire

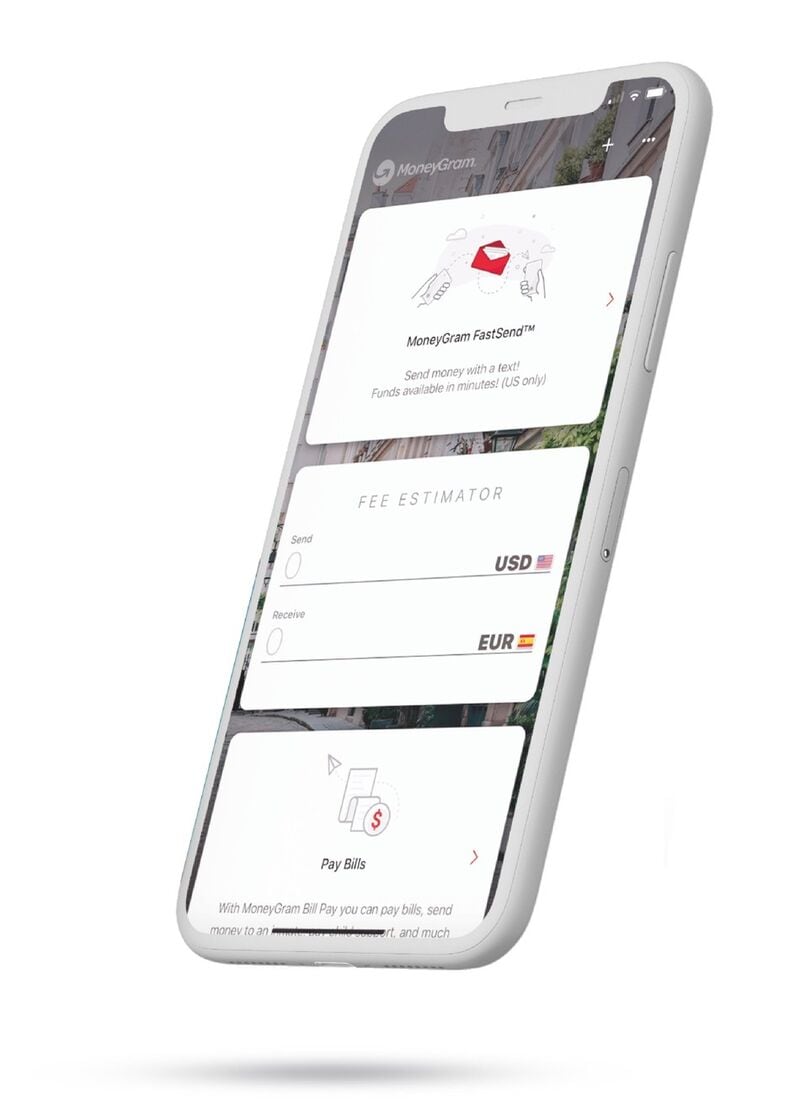

MoneyGram is a cross-border P2P payment and money transfers solution that recently expanded its series to Vietnam. The expansion is thanks to the partnership between MoneyGram, Visa, Sacombank, and other leading banks across the country. According to the brand, "consumers can transfer money digitally through the MoneyGram mobile app or website to arrive almost instantly to any Visa cardholder located in Vietnam."

MoneyGram offers real-time transfer capabilities through any Visa debit or prepaid card, supporting Vietnam's economic growth. Millions of Vietnamese who live and work abroad can now seamlessly send money to friends and family back home – an important feature amid the COVID-19 pandemic when individuals are not able to easily travel or return home.

Image Credit: MoneyGram

MoneyGram offers real-time transfer capabilities through any Visa debit or prepaid card, supporting Vietnam's economic growth. Millions of Vietnamese who live and work abroad can now seamlessly send money to friends and family back home – an important feature amid the COVID-19 pandemic when individuals are not able to easily travel or return home.

Image Credit: MoneyGram

Trend Themes

1. Cross-border P2P Payment Solutions - The trend towards cross-border P2P payment solutions is disrupting traditional money transfer methods and providing new opportunities for collaborations between banks and fintech companies.

2. Real-time Payment Capabilities - The adoption of real-time payment capabilities through debit and prepaid cards is providing consumers with more convenience and flexibility, and creating opportunities for companies to tap into unbanked populations.

3. Mobile Payment Platforms - The rise of mobile payment platforms is revolutionizing the way consumers transfer money, creating opportunities for companies to develop innovative solutions that streamline the payment process and enhance user experiences.

Industry Implications

1. Financial Services - Financial service industries are embracing cross-border P2P payment solutions to improve customer convenience, increase customer retention, and tap into new markets.

2. Fintech - Fintech companies are disrupting traditional financial services by offering innovative payment solutions, driving down transaction costs, and improving efficiency through the use of technology.

3. Mobile Technology - The growth of mobile technology is driving the adoption of new payment methods and providing opportunities for companies to develop user-friendly payment platforms that can be accessed from anywhere, at any time.

1.8

Score

Popularity

Activity

Freshness