Lenny is a Mobile-First App to Help Users Boost Their Credit Scores

Laura McQuarrie — March 23, 2016 — Tech

References: itunes.apple & businesswire

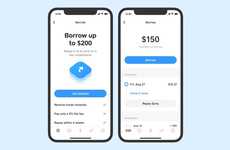

At SXSW this year, a new money lending app named 'Lenny' was launched. The app is specifically targeted towards the Millennial demographic and aims to provide them with convenient ways to access a line of credit, budgeting tips and all the while, boost their credit scores.

To begin with Lenny, users are able to sign up and apply for a credit line from a range of $100 to $10,000, with as little as 0% interest when balances are paid in full and on time. In order to determine the credit score of a user, as a mobile-first money lending app, Lenny uses an algorithm.

As well as being of use for keeping personal finances in check, Lenny also includes a peer-to-peer payment function, which makes it easy to arrange transactions.

To begin with Lenny, users are able to sign up and apply for a credit line from a range of $100 to $10,000, with as little as 0% interest when balances are paid in full and on time. In order to determine the credit score of a user, as a mobile-first money lending app, Lenny uses an algorithm.

As well as being of use for keeping personal finances in check, Lenny also includes a peer-to-peer payment function, which makes it easy to arrange transactions.

Trend Themes

1. Millennial Money Lending - Disruptive innovation opportunity: Develop mobile-first money lending apps that cater specifically to the Millennial demographic, offering convenience and credit-building features.

2. Credit Score Boosting - Disruptive innovation opportunity: Create apps that not only provide access to credit lines, but also offer budgeting tips and tools to help users improve their credit scores.

3. Peer-to-peer Payments - Disruptive innovation opportunity: Integrate peer-to-peer payment functions into money lending apps to allow for easy and convenient transactions between users.

Industry Implications

1. Fintech - Disruptive innovation opportunity: Combine fintech and mobile technology to revolutionize the way Millennials access credit and manage their personal finances.

2. Credit Services - Disruptive innovation opportunity: Develop innovative credit services that leverage algorithmic credit scoring to provide convenient and accessible credit lines for Millennials.

3. Mobile Payments - Disruptive innovation opportunity: Incorporate peer-to-peer payment functions into mobile payment apps to streamline transactions and make it easier for users to send and receive money.

2.8

Score

Popularity

Activity

Freshness