Genkin Simplifies Cash Flow Tracking With AI-Powered Chat-Based Insights

Ellen Smith — March 20, 2025 — Business

References: genkin.site

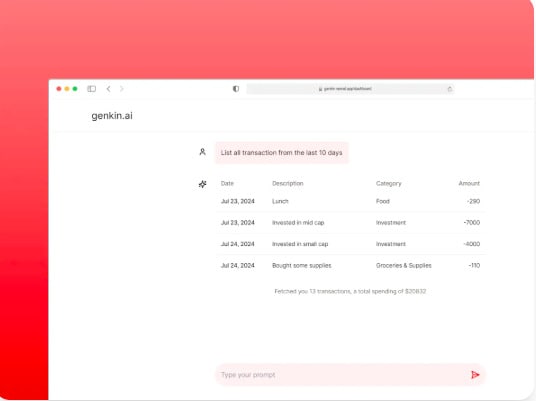

Genkin is a chat-based financial tracking system designed to help users manage cash flow effortlessly. By leveraging AI, it allows users to enter transactions through a conversational interface, reducing the friction of manual data entry. The platform provides interactive charts that offer clear insights into spending habits, enabling users to make informed financial decisions.

Unlike traditional budgeting apps, Genkin prioritizes simplicity and automation, making it accessible for individuals and small businesses alike. Its AI-driven approach ensures that expense tracking is both intuitive and efficient, eliminating the need for complex spreadsheets or manual categorization. As financial management becomes increasingly data-driven, tools like Genkin provide a streamlined solution for those looking to track, analyze, and optimize their cash flow in real-time.

Image Credit: Genkin

Unlike traditional budgeting apps, Genkin prioritizes simplicity and automation, making it accessible for individuals and small businesses alike. Its AI-driven approach ensures that expense tracking is both intuitive and efficient, eliminating the need for complex spreadsheets or manual categorization. As financial management becomes increasingly data-driven, tools like Genkin provide a streamlined solution for those looking to track, analyze, and optimize their cash flow in real-time.

Image Credit: Genkin

Trend Themes

1. Conversational Interfaces - AI-driven chat-based platforms are revolutionizing user engagement by simplifying complex tasks through natural language interactions.

2. Automated Financial Management - The shift towards automated financial tools is streamlining personal and business finance with real-time data and intelligent insights.

3. Data-driven Decision Making - An increasing reliance on data-driven insights is empowering users to make more informed financial decisions quickly and accurately.

Industry Implications

1. Fintech - Fintech is evolving with AI innovations that address the simplification of financial processes and enhance accessibility for users.

2. Artificial Intelligence - The integration of AI in various industries is transforming traditional systems into more intelligent, user-friendly platforms.

3. Personal Finance - Solutions targeting personal finance are incorporating advanced technologies to cater to the growing demand for efficient budget management.

4.2

Score

Popularity

Activity

Freshness