Origin Helps Budget, Invest, Save, and Get AI-Powered Guidance

Ellen Smith — March 12, 2025 — Tech

References: useorigin

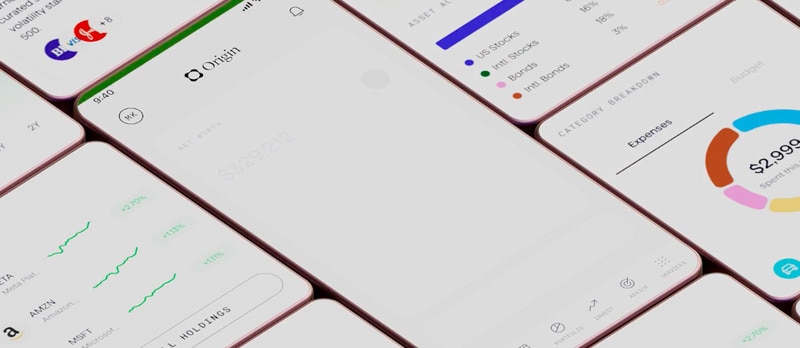

Origin is an all-in-one financial platform designed to help users manage their finances more effectively through AI-powered guidance. The app combines budgeting tools, investment options, and savings features, offering up to 5.8% APY through promotional rates. Additionally, Origin allows users to create a will and provides AI-powered financial advice tailored to individual needs.

For businesses in the fintech and personal finance sectors, Origin presents an integrated solution for consumers seeking to optimize their financial management. Its user-friendly interface enables active investment, streamlined budgeting, and wealth growth, all in one platform. The AI-powered guidance feature can provide personalized advice, potentially increasing user engagement and satisfaction. Origin's blend of traditional financial tools and modern tech-driven features positions it as a strong competitor in the digital finance market, catering to a wide range of financial needs.

Image Credit: Origin

For businesses in the fintech and personal finance sectors, Origin presents an integrated solution for consumers seeking to optimize their financial management. Its user-friendly interface enables active investment, streamlined budgeting, and wealth growth, all in one platform. The AI-powered guidance feature can provide personalized advice, potentially increasing user engagement and satisfaction. Origin's blend of traditional financial tools and modern tech-driven features positions it as a strong competitor in the digital finance market, catering to a wide range of financial needs.

Image Credit: Origin

Trend Themes

1. AI-driven Financial Guidance - The incorporation of AI to offer personalized financial insights is revolutionizing consumer interactions with digital financial services.

2. Integrated Financial Platforms - Platforms combining investment, budgeting, and savings tools are disrupting traditional finance by simplifying comprehensive financial management.

3. High-yield Digital Savings - Offering competitive APYs through digital platforms is reshaping the savings landscape, attracting consumers seeking higher returns.

Industry Implications

1. Fintech - Innovation in fintech is driven by platforms like Origin that integrate technology for a seamless user experience in financial management.

2. Personal Finance - The rise of user-centric financial solutions is altering personal finance, encouraging adoption through ease of use and comprehensive features.

3. Wealth Management - Digital wealth management is being transformed by AI-enhanced tools, enabling personalized and efficient financial planning for users.

6.1

Score

Popularity

Activity

Freshness