Turn Paper Receipts into Categorized Spending Insights with Snapceipt

Ellen Smith — December 4, 2024 — Tech

References: snapceipt

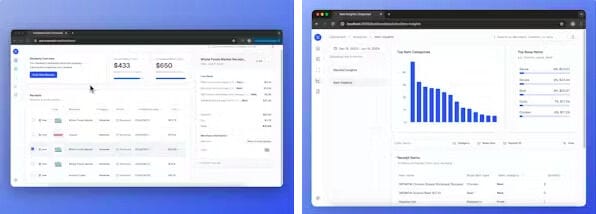

Snapceipt is a digital tool designed to turn paper receipts into actionable spending insights. Users can upload receipts, which are then processed through AI to extract and organize data. The platform categorizes line items, providing users with a detailed breakdown of their expenses.

Over time, Snapceipt enables users to track their purchasing habits, monitor spending patterns, and gain a clearer understanding of their financial behavior. By digitizing and analyzing receipts, the app aims to streamline expense tracking and support more informed financial decision-making. Suitable for personal or professional use, Snapceipt offers a convenient way to consolidate financial data from multiple sources. The tool integrates seamlessly into the workflow of users looking to better manage their finances without manual entry or complex accounting processes.

Image Credit: Snapceipt

Over time, Snapceipt enables users to track their purchasing habits, monitor spending patterns, and gain a clearer understanding of their financial behavior. By digitizing and analyzing receipts, the app aims to streamline expense tracking and support more informed financial decision-making. Suitable for personal or professional use, Snapceipt offers a convenient way to consolidate financial data from multiple sources. The tool integrates seamlessly into the workflow of users looking to better manage their finances without manual entry or complex accounting processes.

Image Credit: Snapceipt

Trend Themes

1. AI-powered Receipt Digitization - AI-powered tools for digitizing receipts are transforming how users manage and streamline their financial data entry.

2. Personal Finance Management Apps - Applications that provide insights into user spending patterns through data analysis are revolutionizing personal finance management.

3. Expense Tracking Automation - Automated expense tracking technologies are making it easier for users to categorize and monitor their spending without manual input.

Industry Implications

1. Fintech - Innovations in financial technology are providing users with seamless tools for better managing their financial behaviors and spending insights.

2. Software-as-a-service (saas) - The SaaS industry is increasingly incorporating AI to offer advanced receipt processing and expense tracking services.

3. Artificial Intelligence - AI applications in consumer finance are enhancing the ability to analyze and organize spending data from paper receipts.

3.3

Score

Popularity

Activity

Freshness