The Combine App Makes Banking Easier for Frequent Travellers and Expats

Alyson Wyers — June 1, 2017 — Tech

References: getcombine & betalist

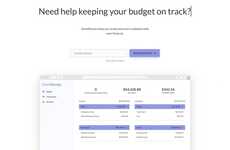

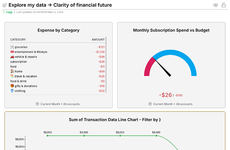

The Combine app, which is currently in beta, helps you track your finances across different countries. Created for people who are moving to a new country or travel frequently, the financial assistant and mobile app shows all your bank accounts from anywhere in Europe in one place to help you to stay in control of your money.

The app also sends you alerts concerning upcoming expenses, offers special promotions and provides online chat support. The Combine app has an AI-powered interface, uses bank-level security and does not store any of your financial information. Users can even use the financial technology to communicate with friends to remind them to pay you back. There is also a personal expense forecast that predicts what your spending will look like in a different city and country.

The app also sends you alerts concerning upcoming expenses, offers special promotions and provides online chat support. The Combine app has an AI-powered interface, uses bank-level security and does not store any of your financial information. Users can even use the financial technology to communicate with friends to remind them to pay you back. There is also a personal expense forecast that predicts what your spending will look like in a different city and country.

Trend Themes

1. Nomadic Finance Apps - Embrace the trend of nomadic finance apps by developing mobile banking solutions that cater to the needs of frequent travelers and expatriates.

2. Financial Tracking Across Countries - Take advantage of the demand for seamless financial tracking across different countries by creating innovative apps or services that consolidate and monitor bank accounts from anywhere in the world.

3. AI-powered Financial Assistants - Explore the potential of AI-powered financial assistants to enhance the user experience by offering personalized recommendations, alerts, and support while ensuring top-level security for sensitive information.

Industry Implications

1. Banking and Financial Technology - The banking and financial technology industry can leverage the nomadic finance app trend to develop cutting-edge solutions that simplify cross-border financial management.

2. Travel and Hospitality - The travel and hospitality industry can tap into the nomadic finance app trend by partnering with or integrating financial tracking capabilities into their services to provide customers with a seamless experience.

3. Artificial Intelligence and Machine Learning - The artificial intelligence and machine learning industry can capitalize on the growth of nomadic finance apps to create advanced algorithms and AI-powered tools that offer personalized financial insights and predictions.

3.8

Score

Popularity

Activity

Freshness