Laka Caters to Cyclists, Boasting Both Bicycle & Recovery Insurance

References: raggededge & laka.co

As a collective insurance provider, Laka remains ahead of the curve in terms of accessibility. The brand does not charge a fixed sum every month but, instead, calculates the premium based on the actual cost of claims. In turn, your maximum contribution will be capped but payments will vary and some months you might not have to pay anything. While 80% of the funds are put into use to fix or support someone's recovery, the other 20% keep Laka afloat.

Laka's collective insurance is specific to cyclists. Individuals are able to cover the theft, damage, or loss of bike, as well as be supported by the brand's recovery plan which taps "only the best specialists and treatments following an accident or injury." This grants access to sports and endurance professionals, wellness services "from physio to dental to mental," as well as virtual GPs for a more efficient experience.

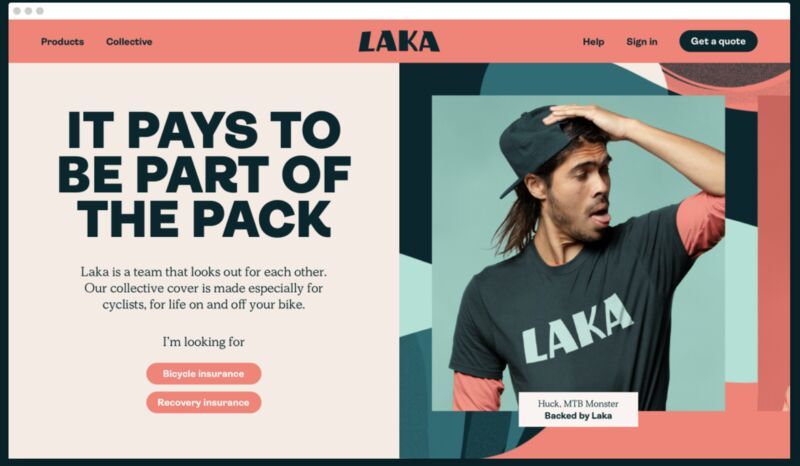

The collective insurance provider recently rebranded in order to challenge "the notion of misfortune and mistrust often associated with the insurance sector." Branding agency Ragged Edge headed the project and was successful in creating a playfully colorful identity.

Laka's collective insurance is specific to cyclists. Individuals are able to cover the theft, damage, or loss of bike, as well as be supported by the brand's recovery plan which taps "only the best specialists and treatments following an accident or injury." This grants access to sports and endurance professionals, wellness services "from physio to dental to mental," as well as virtual GPs for a more efficient experience.

The collective insurance provider recently rebranded in order to challenge "the notion of misfortune and mistrust often associated with the insurance sector." Branding agency Ragged Edge headed the project and was successful in creating a playfully colorful identity.

Trend Themes

1. Collective Insurance - Opportunity for more businesses to offer alternative insurance models that calculate premiums based on actual cost of claims, increasing accessibility for consumers.

2. Targeted Insurance - Opportunity for insurance providers to develop niche insurance policies targeting specific groups of consumers with specialized and tailored coverage.

3. Wellness and Recovery Coverage - Opportunity for insurance providers to include additional coverage related to wellness and recovery services such as physiotherapy, mental health, and virtual doctor visits.

Industry Implications

1. Insurance - More insurance providers can integrate collective insurance model and targeted insurance policies to stand out in the market.

2. Cycling - Expanding niche insurance options, such as Laka's cycling coverage, presents a significant growth opportunity for cycling related products and services.

3. Wellness and Healthcare - Opportunity for wellness and healthcare providers to partner with insurance companies to offer integrated recovery and wellness plans for consumers.

3

Score

Popularity

Activity

Freshness