'Acasa' Makes it Easy to Split Shared Household Bills and Expenses

Laura McQuarrie — August 26, 2017 — Business

References: itunes.apple & psfk

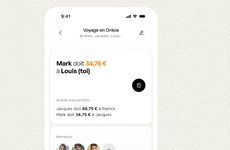

Organizing and splitting the costs of shared utilities and household purchases can be the cause of many disagreements between roommates, but Acasa was created as an app that simply and automatically takes guesswork out of the process.

The app makes it possible for couples, roommates and other larger groups to easily share the costs of Internet, water or cable, as well as household goods like bathroom tissue. Since the process of settling costs with roommates can be both frustrating and uncomfortable at times, the app makes it easy for all parties to see the all costs involved in one easy-to-access place. As such, Acasa notes that its app has the potential to help users "avoid arguments" and other complications over money.

Acasa was previously named Splittable, but the platform has been updated with new branding and a range of new features.

The app makes it possible for couples, roommates and other larger groups to easily share the costs of Internet, water or cable, as well as household goods like bathroom tissue. Since the process of settling costs with roommates can be both frustrating and uncomfortable at times, the app makes it easy for all parties to see the all costs involved in one easy-to-access place. As such, Acasa notes that its app has the potential to help users "avoid arguments" and other complications over money.

Acasa was previously named Splittable, but the platform has been updated with new branding and a range of new features.

Trend Themes

1. Shared-expense Apps - Acasa is one of many shared-expense apps that help roommates and couples split household bills and expenses automatically.

2. Household Expense Tracking - Acasa and other expense-tracking apps are helping to revolutionize how roommates and couples manage household expenses.

3. Payment Automation - Acasa and other similar apps are making it easier to automate payments among groups of people, reducing disputes over costs.

Industry Implications

1. Fintech - Fintech companies that focus on shared-expense apps, like Acasa, could disrupt traditional banking practices for automating payments among groups of people.

2. Real Estate - Shared-expense apps like Acasa are helping to make roommate situations less financially stressful, which could make co-living a more viable option for people.

3. Consumer Technology - Companies in the consumer technology industry could explore ways to integrate shared-expense apps like Acasa into smart home technology, making it even easier for roommates and couples to split household expenses.

2.8

Score

Popularity

Activity

Freshness