Mantle Simplifies Cap Table Management and 409A Valuations for Startups

Ellen Smith — March 17, 2025 — Business

References: withmantle

Cap table management is a crucial aspect of startup and business operations, ensuring accurate tracking of equity ownership, issuance, and compliance. This type of software provides tools for companies to manage their capitalization tables efficiently, allowing founders, investors, and legal teams to access real-time data on company equity.

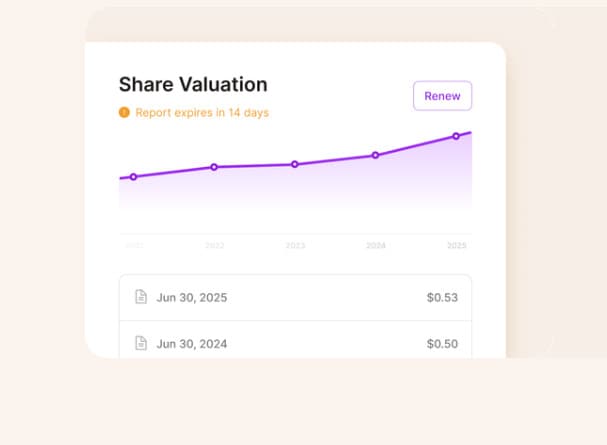

Additionally, automated 409A valuations help businesses remain compliant with regulatory requirements while reducing costs associated with external valuation firms. By integrating essential equity management functions with planning tools, these platforms enable companies to streamline administrative tasks and focus on strategic decision-making. Users can generate reports, model future funding scenarios, and maintain transparency in equity distribution.

For startups and growing businesses, leveraging a cap table management solution minimizes errors, saves time, and improves investor relations through clear, organized equity tracking.

Image Credit: Mantle

Additionally, automated 409A valuations help businesses remain compliant with regulatory requirements while reducing costs associated with external valuation firms. By integrating essential equity management functions with planning tools, these platforms enable companies to streamline administrative tasks and focus on strategic decision-making. Users can generate reports, model future funding scenarios, and maintain transparency in equity distribution.

For startups and growing businesses, leveraging a cap table management solution minimizes errors, saves time, and improves investor relations through clear, organized equity tracking.

Image Credit: Mantle

Trend Themes

1. Automated Cap Table Management - Streamlining equity tracking through automated cap table management revolutionizes the efficiency with which startups handle share allocations and investor updates.

2. Integrated 409A Valuations - Combining cap table platforms with automated 409A valuations significantly reduces the dependence on expensive external valuation services while maintaining compliance with regulatory standards.

3. Real-time Equity Data Access - Providing immediate access to real-time equity data empowers founders and legal teams to make informed strategic decisions in a competitive startup landscape.

Industry Implications

1. Financial Technology (fintech) - The rise of equity management software represents a burgeoning area within FinTech that seeks to enhance transparency and efficiency in startup equity administration.

2. Regulatory Compliance Solutions - Innovations in integrated 409A valuation systems are driving new developments in regulatory compliance technology, helping companies stay current with financial regulations seamlessly.

3. Startup Support Services - Equity management platforms are transforming the startup support sector by offering tools that aid in managing complex financial structures more efficiently.

3.3

Score

Popularity

Activity

Freshness