The 'Soraban' Platform Pinpoints Ways to Maximize Savings

Michael Hemsworth — July 11, 2019 — Tech

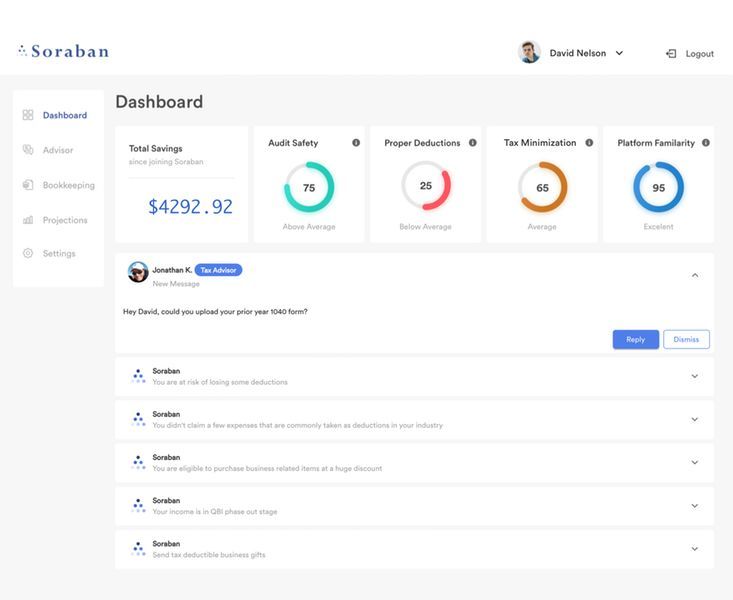

The number of freelancers and self-employed professionals in the market is only increasing, so the 'Soraban' platform is positioned as a solution for them to help them navigate the process of paying taxes.

The platform works to keep all of the various expenses associated with self-employment in one spot and pinpoint exactly how much can be deducted. This could potentially save a professional thousands of dollars each year in taxes by helping them to keep track of everything they can deduct related to their business.

The 'Soraban' platform can be used on a monthly basis for a small fee and eliminates the need for accountants who might not be the best at finding all of the various tax-saving benefits that are available.

The platform works to keep all of the various expenses associated with self-employment in one spot and pinpoint exactly how much can be deducted. This could potentially save a professional thousands of dollars each year in taxes by helping them to keep track of everything they can deduct related to their business.

The 'Soraban' platform can be used on a monthly basis for a small fee and eliminates the need for accountants who might not be the best at finding all of the various tax-saving benefits that are available.

Trend Themes

1. Tax-saving Platforms - Disruptive innovation opportunity: Develop an AI-powered platform that uses machine learning to optimize tax deductions for freelancers and self-employed professionals.

2. Expense Tracking Solutions - Disruptive innovation opportunity: Create a mobile app that simplifies expense tracking for freelancers and self-employed professionals, automating the process and providing real-time data.

3. Subscription-based Accounting - Disruptive innovation opportunity: Offer a subscription-based accounting service specifically tailored for freelancers and self-employed professionals, providing cost-effective and specialized tax advice.

Industry Implications

1. Financial Technology (fintech) - Disruptive innovation opportunity: Combine financial technology and tax services to create a comprehensive platform that streamlines tax management for freelancers and self-employed professionals.

2. Mobile App Development - Disruptive innovation opportunity: Develop a mobile app that integrates expense tracking and tax optimization features, catering to the specific needs of freelancers and self-employed professionals.

3. Accounting and Tax Services - Disruptive innovation opportunity: Rethink traditional accounting services to cater to the growing market of freelancers and self-employed professionals, leveraging technology for cost-effective solutions.

3.5

Score

Popularity

Activity

Freshness