Noda Strives to Provide a Cost-Effective Payment Alternative

Kalin Ned — March 27, 2025 — Art & Design

References: qr.noda.live & finance.yahoo

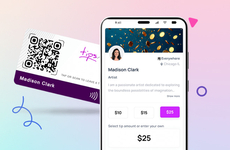

Noda has introduced a QR code-based payment system in the UK that provides offline businesses with a cost-effective alternative to traditional card transactions. The solution enables direct bank transfers through customizable QR codes with a flat £0.20 fee per transaction. This significantly undercuts typical card processing charges.

Noda's QR code-based payment system is designed for service-oriented small businesses like salons, tradespeople, and cafes. The brand offers three QR code variants — dynamic for customer-entered amounts, fixed-value for pre-set amounts, and merchant-controlled for business-determined sums.

Noda's platform integrates with common messaging apps for payment link distribution and provides real-time transaction tracking to simplify financial management. Merchants can onboard through a streamlined process involving a product demonstration, digital paperwork, and immediate access to a payment dashboard upon approval.

Image Credit: Noda

Noda's QR code-based payment system is designed for service-oriented small businesses like salons, tradespeople, and cafes. The brand offers three QR code variants — dynamic for customer-entered amounts, fixed-value for pre-set amounts, and merchant-controlled for business-determined sums.

Noda's platform integrates with common messaging apps for payment link distribution and provides real-time transaction tracking to simplify financial management. Merchants can onboard through a streamlined process involving a product demonstration, digital paperwork, and immediate access to a payment dashboard upon approval.

Image Credit: Noda

Trend Themes

1. Cost-effective QR Payment Adoption - Businesses are increasingly adopting QR code-based payment systems as a cost-effective alternative to traditional card transactions.

2. Direct Bank Transfer Solutions - The rise of direct bank transfers via QR codes presents an opportunity to minimize transaction fees for small businesses.

3. Integration with Messaging Apps - Integrating payment systems with popular messaging apps simplifies payment link distribution and enhances customer convenience.

Industry Implications

1. Financial Technology - The fintech industry is witnessing transformation through the deployment of QR code-based payment solutions that challenge traditional banking fees.

2. Retail and Service - Retail and service sectors have new opportunities to streamline payments and reduce costs with innovative QR code solutions.

3. Mobile Payment Systems - The mobile payment industry is evolving with the integration of customizable QR codes that offer flexibility and real-time transaction tracking.

8.8

Score

Popularity

Activity

Freshness