PhonePe Launches the New Account Aggregator Service for Clients

PhonePe Pvt. has recently unveiled its account aggregator services, made accessible through its wholly-owned subsidiary, PhonePe Technology Services Pvt. This significant development follows the company's acquisition of the NBFC-AA license from the Reserve Bank of India in August of the previous year.

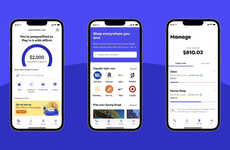

To facilitate this offering, PhonePe has integrated the account aggregator service as a micro-app within its broader PhonePe mobile application. This strategic decision ensures seamless accessibility and a cohesive user experience for customers utilizing the platform.

"The account aggregator service will allow Indian consumers to consent to and share all their financial data, such as bank statements, insurance policies and tax filings, with regulated financial institutions or FIUs (financial information users) for several use cases, such as applying for loans, buying new insurance, getting investment advice, etc," the company stated.

Image Credit: PhonePe Pvt

To facilitate this offering, PhonePe has integrated the account aggregator service as a micro-app within its broader PhonePe mobile application. This strategic decision ensures seamless accessibility and a cohesive user experience for customers utilizing the platform.

"The account aggregator service will allow Indian consumers to consent to and share all their financial data, such as bank statements, insurance policies and tax filings, with regulated financial institutions or FIUs (financial information users) for several use cases, such as applying for loans, buying new insurance, getting investment advice, etc," the company stated.

Image Credit: PhonePe Pvt

Trend Themes

1. Account Aggregation Services - The development of account aggregation services offers an opportunity for financial institutions to improve their customer experience by providing a more cohesive, all-in-one financial platform.

2. Micro-app Integration - The integration of account aggregation services as a micro-app within existing mobile applications presents a unique opportunity for companies to provide a seamless user experience while expanding their product offerings.

3. Financial Data Sharing - The rise of financial data sharing presents an opportunity for regulated financial institutions and FIUs to offer personalized products and services based on a more complete picture of their customers' financial situation.

Industry Implications

1. Banking - The banking industry can leverage account aggregation services to offer customers a more comprehensive digital banking experience.

2. Insurance - The insurance industry can use financial data shared through account aggregation services to offer personalized products and pricing based on a customer's complete financial picture.

3. Investment Services - Account aggregation services offer an opportunity for investment services to provide more personalized and tailored investment advice based on a customer's complete financial situation.

2.1

Score

Popularity

Activity

Freshness