The 'Plum' Personal Savings Assistant Sets Money Aside Accordingly

Michael Hemsworth — June 14, 2016 — Tech

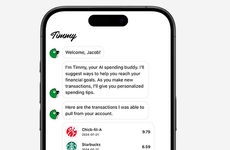

Those looking for a simpler way to save money will find the 'Plum' personal savings assistant to be the best way to organize regular savings. The smart algorithm that 'Plum' uses keeps an eye on how you spend your money and what your average spending habits are. From here, 'Plum' will set aside the amount of money you can afford to save without having to rely on guesswork or constantly have users crunch numbers.

The 'Plum' personal savings assistant also offers users an enhanced interface and design in order to keep track of information. Users can send a text to 'Plum' to get balance information, get tips on how to save even more and gain access to savings if something unexpected pops up.

The 'Plum' personal savings assistant also offers users an enhanced interface and design in order to keep track of information. Users can send a text to 'Plum' to get balance information, get tips on how to save even more and gain access to savings if something unexpected pops up.

Trend Themes

1. Smart Savings Assistants - The development of smart savings assistants like 'Plum' that use advanced algorithms to analyze spending habits and automatically set aside money for savings presents disruptive innovation opportunities in the personal finance industry.

2. Algorithmic Money Management - The rise of algorithmic money management tools, such as 'Plum', that use smart algorithms to track spending habits and help users save money without manual calculations opens up disruptive innovation opportunities in the financial technology (fintech) sector.

3. Conversational Banking - The emergence of conversational banking through apps like 'Plum' that allow users to communicate with a personal savings assistant via text message presents disruptive innovation opportunities in the digital banking industry.

Industry Implications

1. Personal Finance - The 'Plum' personal savings assistant and similar apps that simplify automatic savings can disrupt the personal finance industry and transform the way individuals manage their money.

2. Financial Technology (fintech) - The development of algorithmic money management tools like 'Plum' has the potential to disrupt the fintech industry by offering convenient and automated solutions for saving and managing personal finances.

3. Digital Banking - Apps like 'Plum' that enable conversational banking and provide personalized savings recommendations have the potential to disrupt the digital banking industry by enhancing the user experience and making financial management more intuitive.

3.5

Score

Popularity

Activity

Freshness