The iAllowance Personal Finance App is Made for Tweens and Teens

Michael Hemsworth — December 1, 2015 — Tech

References: itunes.apple & benzinga

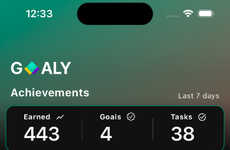

Parental influence over tweens and teens when it comes to finance is a difficult area to navigate, so the iAllowance personal finance app is designed to work with parents and children alike to create an easy way to manage juvenile finances.

Instead of leaving everything in the hands of the child, the iAllowance personal finance app works with both parents and children by setting up automatic allowances and tracking spending habits.

The iAllowance personal finance app can be customized to have a game-like experience with the option to add varying degrees of monetary rewards based on certain chores or activities. Best of all, the iAllowance personal finance app can incorporate the entire family into the experience to make it something for all members to partake in.

Instead of leaving everything in the hands of the child, the iAllowance personal finance app works with both parents and children by setting up automatic allowances and tracking spending habits.

The iAllowance personal finance app can be customized to have a game-like experience with the option to add varying degrees of monetary rewards based on certain chores or activities. Best of all, the iAllowance personal finance app can incorporate the entire family into the experience to make it something for all members to partake in.

Trend Themes

1. Personal Finance Apps for Families - Disruptive innovation opportunity: Develop a personal finance app that allows families to track and manage finances together, with features like automatic allowances and spending habit tracking.

2. Gamification of Financial Education - Disruptive innovation opportunity: Create a gamified app that teaches children and teens about personal finance, incorporating monetary rewards for completing chores or activities.

3. Collaborative Financial Management - Disruptive innovation opportunity: Build a collaborative platform that enables parents and children to work together in managing and making financial decisions.

Industry Implications

1. Personal Finance - Disruptive innovation opportunity: Innovate within the personal finance industry by creating tools and apps specifically designed for families to manage their finances.

2. Edtech - Disruptive innovation opportunity: Foster learning through technology by developing educational apps and platforms that gamify financial education.

3. Family Entertainment - Disruptive innovation opportunity: Merge finance and entertainment sectors by creating interactive experiences that engage the entire family in managing their finances.

3.8

Score

Popularity

Activity

Freshness