The NCR APTRA Interactive Teller Lets You Instantly Chat with Your Bank

Michael Hines — October 4, 2013 — Unique

References: ncr & springwise

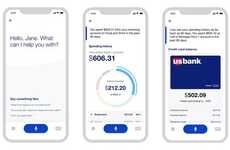

The NCR APTRA Interactive Teller is a new ATM that lets you instantly chat with a bank representative no matter where you are. The machine functions exactly like a normal ATM, save for its speakers and video camera. Should you want to talk to your bank for any reason, simply activate the video feed to speak to a representative.

In addition to being able to help you use the ATM, the banker on the other end of the video feed can also give you quick financial advice and let you know about new offers and promotions. The NCR APTRA Interactive Teller is a win for both banks and the public. Banks don't need to worry about building and staffing physical branches and customers don't need to travel to said branches and wait in line.

In addition to being able to help you use the ATM, the banker on the other end of the video feed can also give you quick financial advice and let you know about new offers and promotions. The NCR APTRA Interactive Teller is a win for both banks and the public. Banks don't need to worry about building and staffing physical branches and customers don't need to travel to said branches and wait in line.

Trend Themes

1. Video-enabled ATM Machines - Disruptive innovation opportunity: Develop advanced AI and machine learning capabilities to automate personalized financial advice in real-time through video-enabled ATMs.

2. Virtual Banking Assistance - Disruptive innovation opportunity: Create AI-powered virtual assistants that can handle various banking transactions and provide personalized financial advice through video-enabled ATMs.

3. Remote Customer Service - Disruptive innovation opportunity: Implement remote customer service solutions that utilize video-enabled ATMs to provide convenient and personalized assistance to customers.

Industry Implications

1. Banking - Disruptive innovation opportunity: Integrate video-enabled ATMs with artificial intelligence and machine learning technologies to revolutionize the banking industry's customer experience.

2. Financial Technology (fintech) - Disruptive innovation opportunity: Develop and enhance video-enabled ATM technologies to enable fintech companies to offer advanced virtual banking services and gain a competitive edge.

3. Customer Service - Disruptive innovation opportunity: Explore the implementation of video-enabled ATMs in customer service industries to provide seamless remote assistance and improve customer satisfaction.

4.2

Score

Popularity

Activity

Freshness