Origin Helps Companies Relieve Employee Stress

Understanding the importance of financial wellness—the need for which has only been exasperated by the ongoing COVID-19 pandemic, which has directly increased the unemployment rate—Origin seeks to make "financial planning [...] more accessible to everyone at every stage of life."

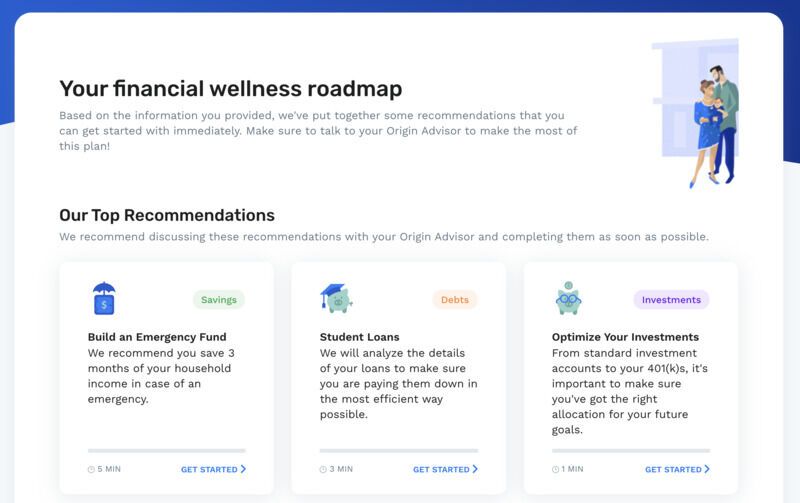

Origin emphasizes the need for employee financial wellness and as a result, looks to partner with companies to offer valuable benefits to their workers. This includes various resources and tools—such as a personalized financial roadmap—as well as tailored advice through 1:1 meetings with Origin Advisors. Origin's platform is inclusive and covers "the full financial spectrum," including student debt, emergency savings, investments, home-buying, and so on. Informative and actionable, the brand supports financial wellness every step of the way, contributing to less monetary anxiety and, therefore, a happier and more productive workplace.

Image Credit: Origin

Origin emphasizes the need for employee financial wellness and as a result, looks to partner with companies to offer valuable benefits to their workers. This includes various resources and tools—such as a personalized financial roadmap—as well as tailored advice through 1:1 meetings with Origin Advisors. Origin's platform is inclusive and covers "the full financial spectrum," including student debt, emergency savings, investments, home-buying, and so on. Informative and actionable, the brand supports financial wellness every step of the way, contributing to less monetary anxiety and, therefore, a happier and more productive workplace.

Image Credit: Origin

Trend Themes

1. Employee Financial Wellness - Origin's platform focuses on improving employee financial wellness through personalized financial roadmaps and tailored advice, presenting opportunities for companies to prioritize the financial well-being of their workforce.

2. Accessible Financial Planning - Origin aims to make financial planning more accessible to employees at every stage of life, highlighting the potential for disruptive innovation in the financial services industry.

3. Comprehensive Financial Spectrum - Origin's platform covers various aspects of personal finance, including student debt, emergency savings, investments, and home-buying, indicating opportunities for innovation in these specific industries.

Industry Implications

1. Financial Services - Origin's emphasis on accessible financial planning presents opportunities for disruptive innovation within the financial services industry.

2. Human Resources - Origin's partnership with companies to offer employee financial wellness benefits suggests opportunities for innovation within the human resources industry.

3. Education - Origin's inclusion of student debt in its financial wellness platform indicates potential for disruptive innovation in the education industry.

2.2

Score

Popularity

Activity

Freshness