ERGO Debuts a VR App for Travel Insurance Consultations

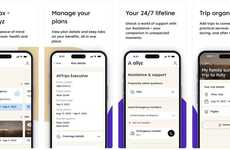

ERGO, a subsidiary of Munich Re, has recently introduced an immersive virtual reality (VR) experience aimed at enhancing consumer engagement and connectivity. Specifically designed for individuals seeking travel insurance, this innovative app offers customers a unique and interactive way to explore coverage options. Through the virtual world, users can understand the risks involved in specific activities and the potential benefits of ERGO's coverage in mitigating those risks.

By offering a virtual consultation service, ERGO aims to establish a more personalized and interactive approach to insurance, which will help deepen its existing relationship with clients.

The ERGO VR experience is available on the brand's new app. Users can book a slot with a consultant to receive a download link for the new service.

Image Credit: ERGO

By offering a virtual consultation service, ERGO aims to establish a more personalized and interactive approach to insurance, which will help deepen its existing relationship with clients.

The ERGO VR experience is available on the brand's new app. Users can book a slot with a consultant to receive a download link for the new service.

Image Credit: ERGO

Trend Themes

1. Virtual Reality Insurance Consultation - A trend towards more personalized and interactive ways of offering insurance coverage through immersive virtual reality experiences.

2. Immersive Customer Engagement - A trend towards using virtual reality technology to enhance customer engagement and connectivity in the insurance industry.

3. Interactive Insurance Applications - A trend towards utilizing new technologies to improve the customer experience and offer more personalized risk management solutions.

Industry Implications

1. Insurance - The insurance industry can benefit from offering immersive and interactive virtual reality experiences to customers in order to enhance engagement and deepen relationships.

2. Travel - The travel industry can benefit from partnering with insurance companies to offer customers innovative ways of mitigating risks through virtual reality technology.

3. Technology - The technology industry can benefit from developing virtual reality applications that are specifically designed for the insurance industry to offer better risk management solutions.

2.6

Score

Popularity

Activity

Freshness