'Double' Creates and Manages Your Personalized Stock Index Portfolio

Ellen Smith — April 8, 2025 — Tech

References: double.finance

Double is a custom investment platform that enables users to design and invest in personalized stock indexes. Unlike traditional index funds, which offer broad market exposure, Double empowers individual investors to curate their own portfolios based on specific preferences, industries, or values.

The platform incorporates tax optimization strategies and provides financial guidance to help users manage portfolios more effectively. Notably, it operates without charging assets under management (AUM) fees, which can appeal to cost-conscious investors seeking greater control and transparency. With intuitive tools, Double lowers the barrier to custom investing, making advanced portfolio strategies accessible to everyday users. For investors looking to align their investments with personal beliefs or market outlooks, while maintaining tax efficiency and avoiding traditional management fees, Double offers a flexible, user-driven alternative to conventional investing models.

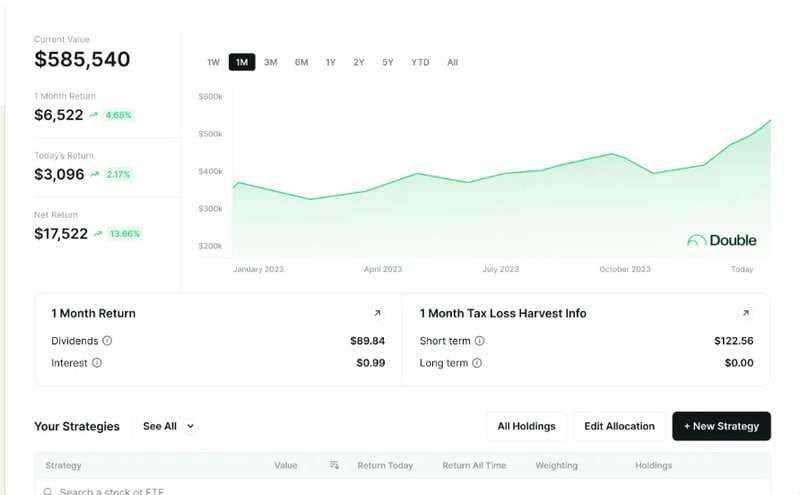

Image Credit: Double

The platform incorporates tax optimization strategies and provides financial guidance to help users manage portfolios more effectively. Notably, it operates without charging assets under management (AUM) fees, which can appeal to cost-conscious investors seeking greater control and transparency. With intuitive tools, Double lowers the barrier to custom investing, making advanced portfolio strategies accessible to everyday users. For investors looking to align their investments with personal beliefs or market outlooks, while maintaining tax efficiency and avoiding traditional management fees, Double offers a flexible, user-driven alternative to conventional investing models.

Image Credit: Double

Trend Themes

1. Personalized Investment Solutions - Personalized investment solutions allow users to tailor their financial portfolios according to individual values and preferences, disrupting traditional one-size-fits-all investment models.

2. Fee-free Investment Platforms - Platforms eliminating traditional management fees challenge conventional investment industry norms, attracting cost-conscious investors seeking transparent and affordable solutions.

3. Tax-efficient Investment Strategies - Innovative platforms focusing on tax optimization offer enhanced portfolio management capabilities, appealing to investors aiming for maximum returns through tailored financial planning.

Industry Implications

1. Financial Technology - Financial technology is transforming how individuals engage with and personalize investment activities, redefining traditional financial services.

2. Investment Advisory Services - Investment advisory services undergo disruption as platforms offer advanced portfolio management tools directly to consumers, bypassing traditional advisory roles.

3. Tax Optimization Services - The rise of tax-efficient investment platforms introduces new opportunities for tax services, blending financial advice with cutting-edge technological solutions.

3.9

Score

Popularity

Activity

Freshness