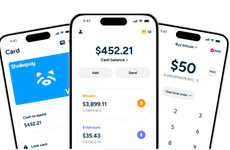

STACK Users Can Directly Receive CERB Benefits for Faster Access

Riley von Niessen — May 5, 2020 — Tech

References: support.getstack & getstack

STACK, an app that offers users instant rewards and tools that can help them to better manage their money, has announced that Canadians will now be able to receive their CERB benefits directly through its app.

To have the money transferred to their STACK accounts, users will need to adjust their settings within the app and include their SIN number. Afterwards, they'll be prompted to give consent and can submit the request. The Canada Revenue Agency will then confirm the changes, after which point users will see their funds directly added to their STACK account.

With this change, STACK users can take advantage of the offers and services that are available through the app, making it easier than ever for them to manage their money and save where possible.

Image Credit: Instagram @getstack_ca

To have the money transferred to their STACK accounts, users will need to adjust their settings within the app and include their SIN number. Afterwards, they'll be prompted to give consent and can submit the request. The Canada Revenue Agency will then confirm the changes, after which point users will see their funds directly added to their STACK account.

With this change, STACK users can take advantage of the offers and services that are available through the app, making it easier than ever for them to manage their money and save where possible.

Image Credit: Instagram @getstack_ca

Trend Themes

1. Direct Benefit Transfer - Apps allowing users to receive benefits directly has the potential to reduce middlemen and increase user convenience.

2. Rewards-driven Budgeting - Integrating rewards programs with budgeting apps provides additional incentive for users to save and make wise financial decisions.

3. Personal Finance Management - Innovative financial management apps continue to disrupt traditional banking models and provide users with more control over their finances.

Industry Implications

1. Financial Technology (fintech) - FinTech companies are utilizing technology to provide consumers with innovative financial products and services, disrupting traditional banking models.

2. Government Benefits - Efficiently delivering government benefits to recipients through the use of technology is an opportunity to reduce costs and improve user experience.

3. Rewards Programs - Integrating rewards programs with personal finance management tools can create opportunities for loyalty incentivization and customer retention in various industries.

0.5

Score

Popularity

Activity

Freshness